Result Expectation: MCB Bank (MCB) is scheduled to announce its CY11E earnings on Tuesday, February 21, 2011. We project the bank to post PAT of PKR21.0bn (EPS: PKR25.16); recording a YoY growth of 25%. For 4QCY11E, we expect the company to post PAT of PKR5.5bn (EPS: PKR6.60); indicating a growth of 26% on a YoY basis. We also expect the bank to announce a cash dividend of PKR3.50/share (taking the total payout to PKR12.50/share) along with a 10% bonus for the year.

Growth in earning assets to drive NII growth: Growth in the bank’s average earning assets combined with higher yields in addition to PKR700mn of suspended markup income (following the conversion of power sector debt into PIBs) would be recorded during 4QCY11. As such NII shall grow by 17% YoY in 4QCY11 and 21% YoY for CY11.

Other Income: Non-fund based income will likely see a growth of 29% YoY during CY11, despite growth slowing down to 21% YoY in 4QCY11. PBT shall be up 24% YoY.

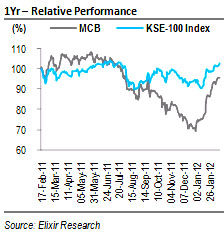

Investment Perspective: The bank is currently trading at CY12 PBV of 1.52x and poses an upside of 16% from present levels. Therefore, we maintain a BUY stance on the stock with Dec-12 target price of PKR216/share.

Growth in earning assets to drive surge in NII

Growth in the bank’s average earning assets by an expected 21% YoY combined with higher yields are expected to result in a 21% YoY increase in MCB’s net interest income (NII) during CY11. The bank is also expected to record PKR700mn of suspended markup income (following the release of circular debt PIBs) during 4QCY11 augmenting NII by 8% QoQ. 4QCY11 NII shall be up 17% YoY.

Advances have remained muted for the year for the entire sector. The same is true in case of MCB which is anticipated to see a slight (0.4%) decline in advances during CY11. Furthermore, provisions against non-performing loans (NPLs) will likely remain flat YoY at PKR3.1bn during CY11 as 90% of NPLs are classified in the ‘loss’ category substantially covered at 83%.

Strong non-fund based income to boost the bottom line

Non-funded income will likely see a growth of 29% YoY during CY11, despite growth likely slowing down to 21% YoY in 4QFY11. Surge in non-interest income shall be backed by a growth in fee income, FX transactions and dividend income. As such, CY11 PBT shall be up by a significant 24% YoY.

Investment Perspective: Maintain a BUY

We expect MCB to continue leading the sector in terms of asset quality and NIMs. Trading at CY12E PBV of 1.52x, we continue to maintain a BUY on the stock with Dec-12 PT of PKR216/share.

Economic & Political News

Foreign exchange reserves rise

Foreign exchange reserves of the country rose to USD16.77bn in the week ending on Feb 10, compared with USD16.69bn the previous week.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By