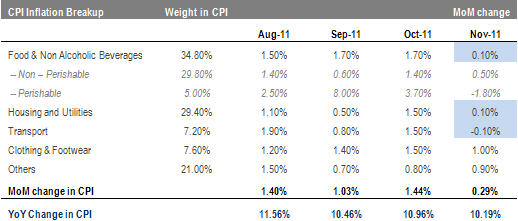

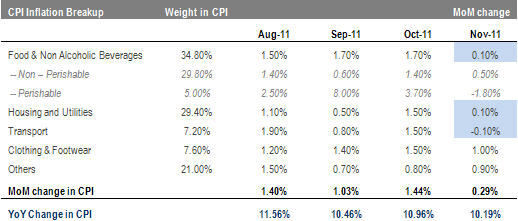

Lower MoM inflation yields a below expected CPI for Nov-11: Nov-11 CPI inflation fell to 10.19%, against a consensus estimate of 10.70%, as MoM CPI inflation fell to 0.29% against an average of 1.3% MoM during 4MFY12.

Stagnant food prices, housing and transportation cost during Nov-11… Average food prices remained stagnant on MoM basis in Nov-11, as decline in prices of non perishable food items offset increase in perishable food items. Average prices of housing subgroup edged up by a marginal 0.1% whereas transportation cost fell 0.1% MoM.

… unlikely to sustain going forward: While non perishable food items would likely witness lower MoM inflation ahead, we understand that lower inflation in transport and housing costs is unlikely to sustain. That said, we still see FY12 CPI inflation to fall well within the 12% target. However, risks remain high for FY13 average CPI.

Lower MoM inflation yields a below expected CPI for Nov-11

Nov-11 CPI inflation fell to 10.19%, against a consensus estimate of 10.70%, taking 5MFY12 average CPI inflation to11.12% YoY. Lower than expected CPI inflation during Nov-11 was an outcome of MoM CPI inflation falling to 0.29% – the lowest since May-11 – against an average of 1.3% MoM during 4MFY12. Other measures of inflation also fell during Nov-11, as WPI clocked in at 11.96% against 4MFY12 average of 17.8% and SPI declined to 5.95% against 4MFY12 average of 11.1%.

Stagnant food prices, housing and transportation cost during Nov-11…

Average food prices rose by a meager 0.1% on MoM basis in Nov-11, as 1.8% decline in prices of perishable food items offset 0.5% increase in non-perishable food items. Perishable subgroup have witnessed a decline in average prices after a sustained rise during the past 4 months – totaling 27% – driven by floods in Sind, which indicates that perishable food items may witness further price declines in the coming months. It is important to note here that perishable food subgroup witnessed YoY inflation of 5.27% during 4MFY12 due to high base effect of last year’s flood. Housing costs, on the other hand edged up by a marginal 0.1%, due

to unchanged House Rent cost, the largest component in the housing segment, which is based on quarterly surveys. Transportation cost fell 0.1% MoM due to decline in motor fuel prices.

… Unlikely to sustain going forward

While non perishable food items would likely witness lower MoM inflation ahead, due to the sharp rise witnessed in price levels during the last four months, we understand that lower inflation in transport and housing costs is unlikely to sustain. Although it is difficult to predict house rent, as it is based on actual surveys, recent strength in oil price, and likely upward revision in gas prices from Jan-12, would push transport and utility costs up, which generally has a broad based lagged effect on general price levels due to cost push inflation. That said, we still see FY12 CPI inflation to fall well within the 12% target. However, risks remain high for FY13 average CPI.

Economic & Political News

Refineries plan USD9.9bn investment to boost capacity

Oil refineries have submitted plans for tentative up-gradation and other associated projects to increase refining capacity to a total of 19.3mntons with an investment of USD9.9bn, according to a working paper submitted to the federal government recently.

PPL’s privatization through SPO to complete next month

The Secondary Public Offering (SPO) of Pakistan Petroleum Limited (PPL) is likely to be completed by next month (January 2012). The PC board in its meeting held on April 20, 2011 had approved the SPO of approximately 2.5% government of Pakistan share in the PPL.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By