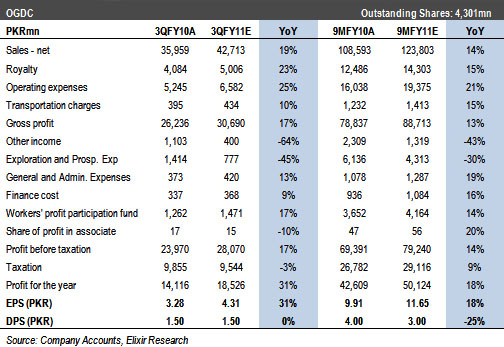

3QFY11 EPS expected at PKR4.31; 9MFY11 at PKR11.65: OGDCL is scheduled to announce its financial result for 9MFY11 on April 27, 2011. We expect the company to announce profit after tax of PKR18.5bn (EPS: PKR4.31) for 3QFY11, up 31% YoY, which shall take 9MFY11 earnings to PKR50bn (EPS: PKR11.65). We also expect the company to announce second interim dividend of PKR1.5/share.

Higher prices to drive earnings amid flattish volumes: With overall hydrocarbon volumes likely to fall 1% YoY, higher oil and gas wellhead prices shall be the key driver for 3QFY11, with oil wellhead likely to rise 35% YoY while gas wellhead shall grow by 11% YoY.

Other income to remain subdued; lower exploration cost to help earnings: While we expect other income to rise 28% QoQ to PKR400mn, it shall remain 64% lower on YoY basis. However, lower 3Q other income will likely be offset by muted exploration cost, expected to fall 45% YoY, as we do not expect any dry well expense during the quarter.

Tax rate expected at 34%: We expect 3QFY11 tax rate to revert back to 34%. 2QFY11 tax rate was 45% as OGDCL wrote down deferred tax assets worth PKR3.3bn, originally booked on account of decommissioning cost.

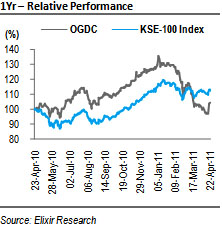

Estimates trimmed; HOLD: We have revised down FY11 other income estimate to PKR1.9bn (9M expected other income at 71% of FY11 estimate) and exploration cost expectation to PKR6.3bn (9M expected exploration cost at 68% of FY11 estimate). We have trimmed our FY11-13 estimates by 2-4%. With the scrip trading at 3% premium to our Dec-11 PT, we have a HOLD stance on OGDCL.

Higher prices to drive earnings amid flattish volumes

OGDCL 3QFY11 oil volumes are likely to fall 5% YoY whereas gas shall be lower by 1%. With overall hydrocarbon volumes likely to fall 1% YoY, higher oil and gas wellhead prices shall be the key driver for 3QFY11 earnings. We expect oil wellhead to rise 35% YoY to USD82/bbl during 1QFY11 while gas wellhead shall be up 11% YoY to USD2.9/mcf.

Other income to remain subdued; lower exploration cost to help earnings

With rising receivables, we expect cash balances to remain depressed during 3QFY11. However, we expect 28% QoQ increase in other income from low 2QFY11 base to PKR400mn. Other income shall still be 64% lower on YoY basis. Lower 3Q other income will likely be offset by muted exploration cost, expected to fall 45% YoY. No dry well was hit by OGDCL during the 3QFY11 and we do not expect any spill over cost from last quarter. However, seismic cost shall rise significantly, with estimates suggesting 70% QoQ increase, as OGDCL shot 475 line km of 2D seismic (+53% QoQ) and 138 sq. km of 3D seismic (+120% QoQ) during 3QFY11. Seismic cost shall however be 19% lower on YoY basis.

Tax rate expected at 34%

We expect 3QFY11 tax rate to revert back to 34%. 2QFY11 tax rate was 45% as OGDCL wrote down deferred tax assets worth PKR3.3bn, originally booked on account of decommissioning cost, barring which 2Q tax rate would likely have been 34%. A mere PKR0.6bn remains on balance sheet as deferred tax assets at Dec-10, and hence we do not expect any deferred tax write offs during 3Q.

Estimates trimmed; HOLD

We have revised down FY11 other income estimate to PKR1.9bn (9M expected other income at 71% of FY11 estimate) and exploration cost expectation to PKR6.3bn (9M expected exploration cost at 68% of FY11 estimate). Resultantly, our FY11 EPS estimate reduces by 2% to PKR15.7. We have also fine tuned FY12-13 other income estimates and reduce our EPS forecasts by 2-4%. We have a HOLD stance on OGDCL, with the scrip trading at 3% premium to our Dec-11 PT.

Economic & Political News

Honda Atlas increases prices

Honda Atlas Cars has increased prices of its various models by PKR32,000 to PKR40,000. Price of Honda City (manual) has been raised by PKR32,000 whereas that for the automatic variant has been increased by PKR35,000. An increase of PKR40,000 has been made on all Civic models.

PM rejects summary of replacements for top officials at oil & gas companies

Prime Minister Secretariat has rejected the summary forwarded by the Ministry of Petroleum and Natural Resources to replace the managing directors of the state-owned oil and gas companies, as the summary was not meeting certain legal provisions, sources said on Monday. The summary contained just one nomination for each institution and according to legal provisions there should be at least three nominations for any such strategic position. The notification has not been yet issued to replace the existing managing directors of the companies.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By