KARACHI: The cash-strapped federal government seems to have either curtailed its budgetary expenditures or diversified its source of financing that has primarily been the local banking system during current fiscal year.

KARACHI: The cash-strapped federal government seems to have either curtailed its budgetary expenditures or diversified its source of financing that has primarily been the local banking system during current fiscal year.

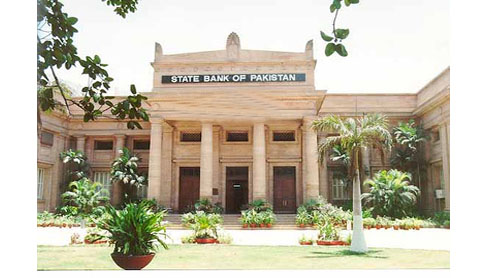

Given the current economic ground realities the above-statement though seems a far distant possibility, certain developments on the financial market indicates that the impression carries some weight. On Wednesday, in what appears to be a surprising move, the funds-starved federal government said no to the scheduled banks’ loan worth over Rs44 billion. Central bank reported that ministry of finance had rejected the Rs44.80 billion bids offered by the primary dealers, mostly banks, against SBP’s auction for the sale of MTBs. The government papers were of 3-, 6- and 12-month maturity periods.

The banks, which have drawn enough criticism for prioritising the risk-free government securities in terms of investment instead of extending advances to the growth-oriented private sector, came up with massive bids worth Rs20.550 billion, Rs17.750 billion and Rs6.500 billion respectively for the three maturity periods. But the government, SBP reported, rejected all bids.

The banking sources view that the rejection was because of the higher rate of return demanded by the banking lenders to the resource-constrained government. “The banks had asked for a rate of return higher by 20 to 25 basis points than the last cut of yield,” said the sources. Another market observer, however, said the government might not needed money, specially, when it was to be repaid on a higher interest rate.

The fact that State Bank has resumed mopping up excess liquidity from the banking system throws enough weight behind the perception that the cash-strapped government seems to have decided to observe restraint in its ongoing borrowing spree from the banks. From July 1 up to Dec 2 (FY12) government, through the central bank, raised over Rs772.40 billion from the state and scheduled banks. The amount stands to be much higher than Rs383.69 billion it had borrowed during the corresponding period last year.

After months of injection operations, SBP on Tuesday and Wednesday (Dec 13 and 14) conducted open market repo sale operation and mopped up Rs1.5 billion and Rs22.50 billion, respectively, from the banking sector. This trend is contrary to the pre-Dec 13 practices of central bank that, some analysts believe, through injecting huge sums in the banking system had been enabling the latter to lend the same amount back to the funds-starved government. The analysts believe that it augurs well for the country if government has enough leverage to say no to bank loans. – PT