PAT up 6% YoY; down 19% QoQ: Fauji Fertilizer Company Limited (FFC) posted a PAT of PKR1,920mn (EPS: PKR2.83) during 3QCY10, down 19% QoQ primarily due to lower Urea offtake. This translated into a cumulative PAT of PKR7,021mn (EPS: PKR10.35) during 9MCY10, up 6% YoY due to healthy dispatches in the previous quarters. The company also announced DPS of PKR2.00/share for 3Q, taking 9MCY10 DPS to PKR9.50/share.

11% YoY ↑ in top-line combined with strong gross margins triggering growth: Despite a decline of 18% QoQ (-32% QoQ decline in Urea offtake to 414k tons during 3Q), net sales increased during the 9-month period by 11% YoY, primarily on the back of 10% hike in Urea prices. Combined with that, healthy margins of around 45% also supported earnings.

Phenomenal dividend from FFBL fueling growth: Other income increased by a significant 172% YoY to PKR716mn during 3Q, as the company received PKR618mn (EPS impact of PKR0.91) from FFBL during 3Q (PKR1.30/share announced during 2Q from FFBL). While during the 9-month period, other income registered an increase of 8% YoY to PKR2,240mn (FFC received PKR1,925mn from FFBL during 9MCY10, up 47% YoY).

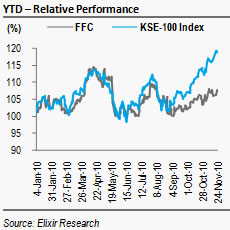

Investment Perspective: At last closing price of PKR110.6/share, FFC offers potential upside of 11% to our DCF based June-11 PT of PKR123/share. The scrip currently trades at CY11E P/E multiple of 7.6x and offers CY11E dividend yield of 13%. Hence, we recommend risk-averse investors to Buy!

Jump in top-line coupled with strong gross margins triggering growth

During 3QCY10, net sales of the company decreased by 18% QoQ to PKR8,559mn due to 32% QoQ decline in Urea offtake to 414k tons. However, during the 9-month period, top-line witnessed an increase of 11% YoY stemming from 10% YoY increase in Urea prices. Combined with that, a strong gross margin of 45% also led to a growth of 10% YoY in gross profit to PKR12,718mn.

Dividend from FFBL fueling growth

FFBL announced a cash dividend of PKR0.50/PKR1.30 during 1Q/2Q which only trickled to FFC during 2Q/3Q. With 50.9% of FFBL held by FFC, other income during the 3Q jumped by a significant 172% to PKR716mn. Cumulatively, during the 9-month period, other income registered an increase of 8% YoY to PKR2,240mn, with FFC receiving PKR1,925mn from FFBL, up 47% YoY.

Intention to acquire 79.85% of AGL

FFC recently expressed its interest in acquiring 79.85% of Agritech Ltd (AGL) from Azgard Nine Ltd (ANL). While no significant details have been disclosed in this regard, we expect the acquisition to be financed through heavy borrowing, which in our view could hurt FFC’s dividend paying capability. In the longer term, however, the acquisition will bear fruits for the company in the shape of higher top-line and dividend income triggering earnings growth. However, we have not incorporated it in our model as it is yet to be finalized.

Investment Perspective

We maintain a Buy stance on the company with a DCF based June 2011 PT of PKR123/share, offering a potential upside of 11% from current levels. At last closing price of PKR110.6/share, the scrip trades at CY11E P/E multiple of 7.6x and offers CY11E dividend yield of 13%.

Economic & Political News

Deregulated petroleum products: Ogra directed to monitor prices

The Cabinet Division has directed the Oil and Gas Regulatory Authority (Ogra) to monitor the prices of deregulated petroleum products till amendments in Ogra Ordinance are finalized. Last month, the Economic Co-ordination Committee of the Cabinet had approved a proposal of the Ministry of Petroleum and Natural Resources to deregulate petroleum products prices by doing away with common freight pool, and directed the Ministry to place the matter before the Cabinet for ratification, subject to amendment in Ogra Ordinance 2002 prior to implementation of the decision.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By