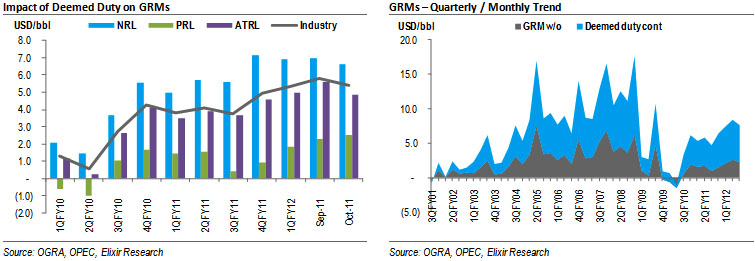

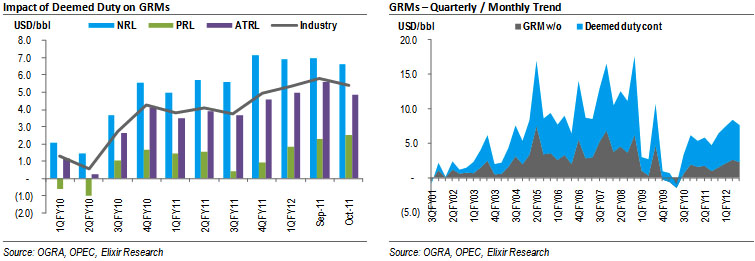

Oct-11 GRMs declined marginally: Gross refining margins for the local refineries declined to USD5.39/bbl in Oct-11, down 7% MoM. We have restated Sept-11 GRMs, increasing it by USD0.9/bbl, based on actual Arab Light price available for Sept-11.

Light distillates pare down Oct-11 GRMs: Light distillates were the only drag on Oct-11 GRMs, owing to decline in MS and naphtha spreads. MS spread was massively down by 92% MoM (USD0.42/bbl) mainly due to cheap imports by PSO, whereas naphtha deficit widened by USD3.43/bbl to average USD-8.44/bbl. In contrast, a limited decline in gasoil prices, led to 4% MoM expansion of its spread. Furthermore, tight supply condition led to a marginal improvement of USD2.2/bbl in FO deficit, which clocked in at USD-9.23/bbl.

ATRL’s GRM witnessed the largest decline: Amongst the listed refineries, ATRL’s Oct-11 GRM registered the highest decline of 14% MoM to USD4.84/bbl, whereas NRL’s GRM was down by 5% to USD6.62/bbl. PRL’s GRM clocked in at USD2.52/bbl during Oct-11.

OMC margins revised up to the promised levels: GOP has revised up OMC margins for MS/HSD by PKR0.16/0.14, to the committed level of PKR1.98/1.76 per liter. GOP had approved staggered increase in MS/HSD margin by PKR0.48/0.41 per liter on 26 August 2011.

Oct-11 GRMS declined marginally

Oct-11 gross refining margins for the local refineries declined to USD5.39/bbl, down 7% MoM. Due to one month lag pricing, Oct-11 GRMs will determine Nov-11 profitability for the local refineries. Lower than expected Arab Light prices for Sept-11 led to USD0.91/bbl increase in our Spet-11 GRMs, which have now been revised to USD5.81/bbl.

Light distillates pare down Oct-11 GRMs

5% MoM decline in light distillates outpaced the reduction in crude oil prices of 3% MoM, thus leading to 7% MoM decline in Oct-11 GRMs. Amongst the light distillates, MS spread witnessed a noteworthy decline of 92% MoM (USD0.42/bbl) primarily due to cheap imports by PSO. Nov-11 ex-refinery prices of MS at PKR58.6/liter (exclusive of incidentals) implied a RON rating of a mere 84 as against 87 allowed earlier (pre deregulation). Owing to weak demand from petrochemical complexes amid trough margins, naphtha deficit further widened by USD3.92/bbl to USD-8.44/bbl during Oct-11.

Amongst middle distillates, expectation of high heating oil demand from West during winter led to a limited decline of 1.4% MoM in gasoil prices during Oct-11, despite of ebbed demand from top buyers (India and Indonesia). Gasoil spread widened by 4% MoM to USD13.38/bbl, during Oct-11. Furthermore, FO discount to crude oil witnessed a marginal improvement of USD2.2/bbl to USD-9.23/bbl, due to tight supply condition on the back of lack of inflows from the west.

ATRL’s GRM witnessed the largest decline

With 35% of its product slate comprising of light distillates, ATRL’s GRM registered the highest decline of 14% MoM to average USD4.84/bbl. While 28% of NRL’s products slate comprises of light distillates, it GRM was 5% down MoM to USD6.62/bbl. PRL’s GRM averaged at USD2.52/bbl during Oct-11.

OMC margins revised up to the promised levels

3rd and final stage of increment in OMC margins has been implemented on 1 November 2011, where OMC margins for MS/HSD have been revised up PKR0.16/0.14 per liter. With that increase, OMC margins for MS/HSD have now arrived at the promised level of PKR1.98/1.76. GOP had allowed a staggered increase in MS/HSD margin by PKR0.48/0.41 in an ECC meeting held on 26 of August 2011.

As per the November price announcement, decline in ex-refinery prices has been largely offset by the increment in petroleum development levy, as has been the case in the preceding month. MS/HSD ex-refinery prices for Nov-11 were down by PKR4.58/1.36 per liter, compared to PKR1.54/0 per liter cut in their Ex-Depot prices. PDL on MS and HSD has been increased by 46% MoM and 3% MoM respectively. While PDL on HOBC and LDO remained unchanged.

Economic & Political News

July-October tax collection stands at PKR492.406bn

The Federal Board of Revenue has provisionally collected PKR492.406bn during first four months (July-October) of 2011-12 against PKR397.043bn in the corresponding period last fiscal year, reflecting an increase of 24%. According to the revenue collection data compiled here on Tuesday, the net sales tax collection amounted to PKR240.158bn during first four months of 2011-12 against PKR180.486bn in the same period last fiscal year, reflecting an increase of 33.1%.

USAID remained largest assistance provider in Oct

Pakistan received USD240.8mn as external assistance in the month of October, where USAID disbursed USD82.31mn.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By