Result expectation: Lucky Cement is scheduled to announce its 3QFY11 results on April 16, 2011. We expect the company to post a 3QFY11 PAT of PKR942mn, up 44% YoY (EPS: PKR 2.92). Growth in profitability will come on account of improved EBITDA margins. 9MFY11 earnings are expected at PKR2.4 bn (EPS: PKR7.44), down 6% YoY!

Higher margins to propel earnings growth: Impetus for bottom-line growth during 3QFY11 will likely be higher EBITDA margins. We expect EBITDA margins to show an increase of 10% QoQ (up 52% YoY) during 3QFY11 to PKR1104/ton primarily due to higher retention prices coupled with pre-buying/inventory pile up of coal at USD 110/ton.

Strong local dispatches while exports to remain under pressure: We expect LUCK’s 3QFY11 local dispatches to rise by 11% YoY and 18% QoQ to 0.98mn tons due to post winter seasonal uptick, whereas export offtake is likely to post a decline of 39% YoY and 16% QoQ to 0.48mn tons due to dismal demand from the GCC region.

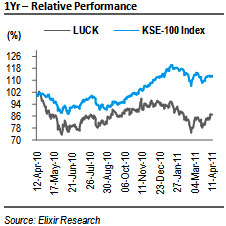

Investment perspective: We have raised our FY11/FY12 EPS by 10% and 3% to PKR10.81 and PKR10.91 respectively, primarily due to improved EBITDA margins. At the last closing price of PKR70/share, LUCK offers an upside of 21% to our Dec-11 price target of PKR85/share and trades at FY11/12 PER of 6.5x/6.4x. BUY!

Higher margins to propel earnings growth

Amid 13%YoY decline in total dispatches during 3QFY11, impetus for bottom-line growth will likely be higher EBITDA margins. We expect EBITDA margins to show an increase of 10% QoQ during 3QFY11 primarily due to higher retention prices coupled with pre-buying/inventory pile up of coal at USD 110/ton. However, EBITDA margins will increase by

52% YoY, due low base effect of 3QFY10. EBITDA margins for LUCK lost footing post 1QFY10 and stood at PKR 726/ton in 3QFY10 before bottoming out in 4QFY10 at PKR 627/ton, following which they have been on a rising trend. Average retentions for 3QFY11 are expected at PKR 4,485/ton (up 27% YoY), due to increase in domestic cement prices, which shall more than offset 17% YoY increase in cash COGS/ton.

Strong local dispatches while exports to remain under pressure

We expect LUCK’s 3QFY11 local dispatches to rise by 11% YoY, while increasing by 18% QoQ to 0.98mn tons due to post winter seasonal uptick. Export offtake is likely to post a decline of 38% YoY and 16% QoQ to 0.48mn tons. Sluggish construction activities coupled oversupply of cement in the GCC region will keep export demand growth in the negative territory. However, cement demand from Africa and Afghanistan will lessen the magnitude of decline from the GCC region. With limited avenues to explore on the export front, LUCK is likely to have focused more on local sales during 3QFY11 due to higher retention prices in comparison to exports. We estimate local retention to have averaged PKR 3952/ton during 3QFY11, whereas export retention, after adjusting for logistic charges is estimated at PKR3673/ton.

Investment perspective

We have raised our FY11/FY12 EPS by 10% and 3% to PKR10.81 and PKR10.91 respectively, primarily due to improved EBITDA margins. At the last closing price of PKR70/share, LUCK offers an upside of 21% to our Dec-11 price target of PKR85/share and trades at FY11/12 PER of 6.5x/6.4x. BUY!

Economic & Political News

Sale of cars swells to 13,579 units

Overall sale of locally assembled cars swelled to 13,579 units in March 2011 as compared to 11,645 units in February 2011 amid persistent arrival of up to five year-old used cars since January 2011. Overall car sales showed growth of 13.09% in July-March 2010-2011 to 97,804 units as compared to 86,483 units in the same period of last fiscal year despite rising car prices due to yen appreciation against various currencies, imposition of 1.5% federal excise duty.

First IPO after 12 months over-subscribed

Initial Public Offering (IPO) of International Steel Limited (ISL) which hit the stock market on Tuesday, received subscription to 81mn shares against 62mn on shares on offer. Another 20.6mn share (4.7% of capital) are to be allocated for pre-IPO foreign investors and 27.5mn shares (6.3% of capital) would be on offer for subscription to the general public. That would be at the strike price.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By