February-11 Urea/DAP ↓ 6%/1% YoY: Offtake of both Urea and DAP registered a decline of 6% YoY and 1% YoY respectively mainly on the back of lower availability due to gas curtailment and plant shutdown for players on Sui network. Cumulative Urea and DAP dispatches plunged by 18% YoY to 807k and 21% YoY to 128k tons respectively during 2MCY11.

Gas curtailment & excess demand keeps prices firm: Urea/DAP prices have surged 37%/24% YoY to PKR1,114/PKR3,211 per bag during Feb-11 primarily attributable to 1) Gas curtailment restricting supply and 2) Excess demand situation prevalent in the country. Despite lower volumes due to gas curtailment and plant shutdowns, we believe top-line will continue to post positive growth on the back of rising prices.

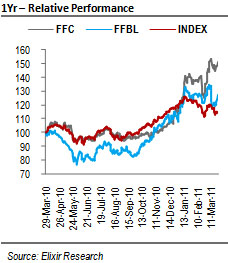

Future outlook – 1Q to be the best for FFC: We foresee a strong year ahead as agricultural activity will pick-up post flood devastation. As far as 1QCY11 financial results are concerned, FFC is most likely to be the best performer. While volumes may trim on YoY basis, earnings growth shall emanate from 1) Strong prices and margins of Urea 2) PKR3.5/share to be received as dividend from FFBL (earning impact of PKR1.77/share).

February-11 Urea/DAP ↓ 6%/1% YoY

During the month of February, volumetric sales of Urea and DAP witnessed a decline to 413k tons and 69k tons respectively, mainly on the back of lower availability due to gas curtailment and plant shutdown for players on Sui network. Cumulative Urea/DAP dispatches during 2MCY11 plunged by 18%/21% YoY to 807k/128k tons. With Kharif sowing season expected to start soon (Sugarcane sowing shall start from February; Rice and Cotton sowing to start from mid April), we anticipate fertilizer demand to pick up. Urea will witness a stable trend throughout the year, while in case of DAP, pre-Rabi season accumulation will come in 2H.

Gas curtailment & excess demand keeps prices firm

During the month of February, Urea prices have surged 37% YoY to PKR1,114/bag mainly attributable to 1) gas curtailment restricting supply and 2) excess demand situation prevalent in the country. Meanwhile, DAP prices have surged 24% YoY to PKR3,211/bag on the back of rising international commodity prices. Consequently, during 1QCY11, despite lower volumetric sales, we believe top-line will continue to post positive growth on the back of rising prices.

Investment Perspective – 1Q to be the best for FFC!

We foresee a strong year ahead as agricultural activity will pick-up post flood devastation. FFC is expected to be the top performer in the sector during the upcoming result season. While volumes may trim on YoY basis, earnings growth shall emanate from 1) Strong prices and margins of Urea and 2) PKR3.5/share to be received as dividend from FFBL (earning impact of PKR1.77/share).

Economic & Political News

Widening gap: Government faces PKR65bn shortfall in tax collection

Authorities are facing a PKR65bn shortfall in the 9MFY11. Provisional tax collection data shows that until March 26, the Federal Board of Revenue (FBR) managed to collect PKR975bn, while authorities were expecting to collect up to PKR25bn in the remaining five days of the month. Still, FBR will be PKR65bn short of the July-March target of PKR1,064bn

Turkey’s move to impose duty on textile: Pakistan to face USD200mn loss

Pakistan would suffer a USD200mn loss in terms of lower textile exports consequent to Turkey’s decision to impose 18% additional custom duty on imports from Pakistan.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By