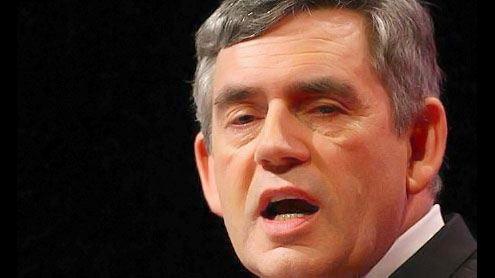

LONDON: Ex-prime minister Gordon Brown admitted that he made a “big mistake” in not seeking tighter regulations on banks in the lead up to the financial crisis.The former leader told a conference in the US that he had not fully appreciated how “entangled” the global financial system had become when establishing the Financial Services Authority (FSA), the country’s regulatory body.

LONDON: Ex-prime minister Gordon Brown admitted that he made a “big mistake” in not seeking tighter regulations on banks in the lead up to the financial crisis.The former leader told a conference in the US that he had not fully appreciated how “entangled” the global financial system had become when establishing the Financial Services Authority (FSA), the country’s regulatory body.

“We set up the FSA believing the problem would come from the failure of an individual institution,” Brown said. “That was the big mistake. We didn’t understand just how entangled things were.”I have to accept my responsibility.”New Chancellor of the Exchequer George Osborne has announced plans to break up the FSA and hand more regulatory power to the Bank of England.Brown said he believed the will to tighten regulation was weakening in the face of lobbying by the financial sector.”I do believe we’re going back to a race to the bottom,” he warned.”There should be an international agreement, otherwise you’ll just have banks threatening to move from one country to another,” continued Brown.”Britain was under relentless pressure from the City (Britain’s financial centre) that we were over-regulating. All through the 10 to 15 years, the battle was not that we regulated too little, but that we regulated too much,” he added. – Yahoonews