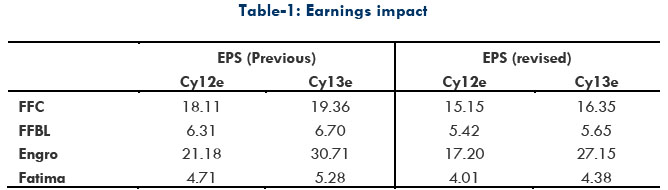

Compelled to cut prices: Entering Kharif season with more than a million ton inventory and limited storage capacities, fertilizer manufacturers were compelled to cut urea price by PKR 145/bag. Huge inventory pile up amid cheaper imported urea, remained the main impetus behind the price reduction. According to industry sources, the reduced price of PKR 1,650/bag is applicable for 30-days period, however we do not see any reversal of the decision as imported urea is still at a discount of PKR 50/bag. Meanwhile in an election year, imported urea price is likely to remain subsidized. Engro is a major loser in recent move, as cushion against gas curtailment faded (previous price hikes were on account of gas curtailment on SNGPL network).

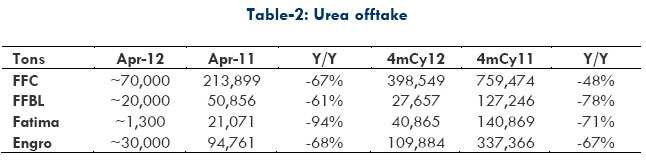

April presenting the same story: April-12 turned out to be another depressing month for the fertilizer companies, as according to our channel checks urea offtake for April went down by ~70% Y/Y for local players. Dealers remained interested in buying cheaper imported urea, as contribution of imported urea in total urea sales lifted from 14% in 1qCy11 to 53% in 1qCy12. Moreover, fertilizer manufacturers are now even short of storage capacity, which compelled them to enter a price war. As government is mulling to import ~600k tons of urea for Kharif season, we expect domestic players to witness a huge blow in their offtakes going forward.

Gas crisis posing highest threat ever: Approaching elections have diverted government’s priorities of gas allocation towards power and domestic consumers relative to the fertilizer sector. Engro’s new plant remained operational only for ~35days since Jan-12 and is still struggling with the gas issue. In order to avoid agitation from masses, power sector is likely to get priority over fertilizer sector during Cy12. According to our channel checks, government is considering shutting SNGPL based plants till Sep-12 and fulfill the lost production with imported urea. Engro’s position is highly exposed to any such move, as price increase is no more an option under prevalent scenario. Moreover, Engro’s debt repayment capacity also poses a threat to sustainability of the company.

Analyst Certification

The research analyst(s), Muhammad Shamoon Tariq, for this report certifies that: (a) all of the views expressed in this report accurately reflect his personal views about any and all of the subject securities or issuers; and (2) no part of any of the research analyst’s compensation was, is, or will be directly or indirectly related to the specific recommendations or views expressed by the research analyst(s) in this report.

Disclaimer

This report has been prepared by Optimus Capital Management (Pvt.) Ltd. [Optimus] and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Optimus makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Optimus and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report. Optimus as a firm may have business relationships, including investment banking relationships with the companies referred to in this report. This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Optimus accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents. This report may not be reproduced, distributed or published by any recipient for any purpose.