1HFY12 EPS expected at PKR33.81: Attock Petroleum Limited is scheduled to announce its results for 2QFY12 on 1st February, 2012, where the company is expected to post PAT of PKR1.2bn (EPS: PKR17.92), up 43% YoY. This is expected to take first half earnings to PKR2.3bn (EPS: PKR33.81), up 34% YoY. Along with 2Q result, APL is expected to announce interim dividend of PKR15/share.

25% YoY increase in volumes during 2QFY12: Helped by 89% YoY and 59% YoY improvement in HSD and MS volumes respectively, APL’s 1HFY11 offtake improved by 30% YoY. 2QFY12 volumes registered a growth of 25% YoY, while it remained almost flat on QoQ basis. Jet fuel witnessed a decline of 40% YoY during 2QFY12 due to the ban on fuel exports to Afghanistan.

Margins up 20% YoY during 2QFY12: During 2Q, MS/HSD’s margins/liter were up 27%/12% YoY, while 42% jump in FO prices would likely have filtered into similar increase FO margin. Along with an estimated inventory gain of PKR267mn, APL’s gross margin/ton during 2QFY12 is expected to report an increase of 34% YoY during 2QFY12, while for 1H it is anticipated to rise by 20% YoY.

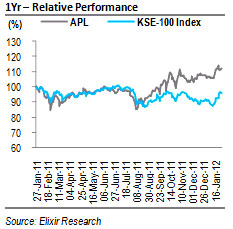

BUY stance intact:At the last closing price, the scrip offers an upside of 32% to our Dec-12 PT of PKR575/share and FY12 dividend yield of 10%. BUY!

25% YoY increase in volumes during 2QFY12

APL’s 2QFY12 volumes improved by 25% YoY, primarily on the back of 67% YoY and 36% YoY growth in HSD and MS volumes. FO offtake inched up by a mere 8% YoY, while Jet fuel remained the major loser amongst the fuel products where it volumes plunged 40% YoY during 2Q. Abandoning of fuel supply to Afghanistan was the major reason for the decline in jet fuel. Asphalt volumes were down by 9% YoY during 1HFY11, while 2Q asphalt offtake edged up 39% YoY. 1HFY12’s offtake were up by 30% YoY, mainly due to 89% YoY and 59% YoY jump in HSD and MS volumes.

Margins up 20% YoY during 2QFY12

FO prices were up 42% YoY during the quarter, which shall translate into similar increase in its margin. Additionally, per liter margins for HSD/MS were up 27%/12% YoY during 2Q. With an estimated PKR267mn inventory gains, APL is expected to realize 34% YoY increase in gross margin per ton. 1HFY12 margins shall be up 20% YoY.

During 2QFY12, we anticipate other income to grow by 11% YoY on the back 3% YoY jump in handling income and 20% YoY rise in late payment charges. Furthermore, 3% PKR deprecation is expected to result in an estimated exchange gain of PKR22mn during 2Q, nearly 5x of other income during same of period last year. 2HFY12 other income is expected to move up by 20% YoY.

Economic & Political News

GDP 4.2% growth target may be missed: SBP

The State Bank said that average inflation by the end of this year was likely to be close to 12% while the country might miss the GDP growth target of 4.2% set for the current financial year. It noted that realization of the 4.2% GDP target looked difficult because of gas shortage, high oil prices and decline in global prices for agricultural commodities. The budget deficit for the first quarter (July-September) of FY12 was 1.2% of GDP, compared to 1.5%during the same period last year. Reduced deficit was because of 29.7%increase in the FBR revenue.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By