Expansion in earning assets and higher NIMs driving NII growth: 22% YoY increase in interest income compared to 26% YoY increase in interest expense led the bank to post a YoY growth of 18% in its Net Interest Income (NII) for 9MCY11. Earning assets expanded by 6% since Dec-10 while deposits grew by a meager 1.2% during the same period. NIMs were up by 50bps.

Slowdown in NPL accretion…: CY11 has seen a slowdown in further accretion when NPLs have grown by only 12% since Dec-10 with infection ratio at 14.9% as of Sep-11. Furthermore, provisions for 9MCY11 were 7% higher YoY on the back of ageing of previously classified accounts.

….and decline in CY12 provisions to compensate for NIM shrinkage: Lately, decline (2% since Dec-10) in advances combined with an expected growth of 4% (5 year CAGR) in the same going forward will likely keep NPL growth subdued in the following quarters. Subsequently, provisions will likely see a decline of 8% YoY during CY12E.

Focus on branchless banking to improve cost-to-income: Cost to income ratio witnessed an improvement to 38% during 9MCY11 compared to 40% during the same period last year. Constant focus on technological innovation and branchless banking will continue to improve this ratio going forward

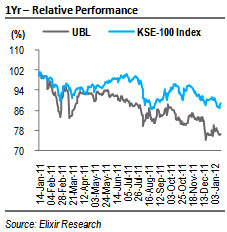

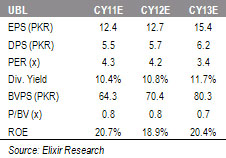

Investment Perspective: UBL has managed to post consecutive QoQ increases in its ROE from 18.5% as of Dec-10 to 23.4% as of Sep-11. Our Dec-12 PT of PKR67 presents a potential upside of 26% from current levels. The scrip is trading at CY12E P/E and P/BV of 4.2x and 0.7x respectively. BUY!

Expansion in earning assets and higher NIMs driving NII growth

22% YoY increase in interest income compared to 26% YoY increase in interest expense led the bank to post a YoY growth of 18% in its Net Interest Income (NII) for 9MCY11. Earning assets expanded by 6% since Dec-10 with advances and investments growth clocking in at -2% and 19% respectively. Simultaneously, the bank witnessed a meager growth of 1.2% in its deposit base since Dec-10 against industry growth of 6% during the same period. Furthermore, its deposit mix also remained unchanged with fixed portion at 31% and CASA deposits at 69%. NIMs expanded by 50bps during the same period.

Slowdown in NPL accretion…

The bank witnessed 75% growth in non-performing loans (NPLs) from CY08 to CY10 and consequently, infection ratio increased from a mere 7.1% as of Dec-08 to 13.2% as of Dec-10. Textile sector (28%) and individuals (27%) accounted for the majority of bad loans as of Dec-10. However, CY11 has seen a slowdown in further accretion when NPLs have grown by only 12% since Dec-10 with infection ratio at 14.9% as of Sep-11.

Furthermore, provisions for 9MCY11 were 7% higher YoY on the back of ageing of previously classified accounts. Infected loans grew by PKR8.2bn YoY and by PKR2.8bn QoQ to PKR54.5bn as of Sep11. Therefore, loss coverage increased to 75% as of Sep-11 up from 72% as of Dec-10.

….and decline in CY12 provisions to compensate for NIM shrinkage

Lately, decline (2% since Dec-10) in advances combined with an expected growth of 4% (5 year CAGR) in the same going forward will likely keep NPL growth subdued in the coming quarters. Subsequently, provisions will also see a decline of 8% YoY during CY12 thereby, compensating for NIM shrinkage (18bps YoY) with policy rate cut.

Focus on branchless banking to improve cost-to-income

Non-interest income posted an increase of 21% YoY derived from income from derivatives, FX (+27% YoY) and fee income (+6% YoY). Further, cost to income ratio has also witnessed an improvement to 38% during 9MCY11 compared to 40% during the same period last year. Constant focus on technological innovation and branchless banking will continue to improve this ratio going forward.

Investment Perspective: 26% potential upside to Dec-12 TP of PKR67

UBL has managed to post consecutive QoQ increases in its ROE from 18.5% as of Dec-10 to 23.4% as of Sep-11. Therefore using sustainable growth rate of 11.7%, Cost of Equity of 20%, and Return on Equity (ROE) of 19.5% our Dec-12 PT comes to PKR67 (target Justified P/BV of 0.95x). The scrip is currently trading at CY12E P/E and P/BV of 4.2x and 0.7x respectively. BUY.

Economic & Political News

US – based consortium offers USD10bn investment

A consortium of US – based lignite mining giants has offered to invest USD10bn in a large energy complex in Thar to produce 600MW of coal – based power and first in Pakistan the concept of gasification and production of liquid fuel from coal. The project to be completed in three phases would start generating 200MW of electricity in the first phase which would be increased to 6000MW.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By