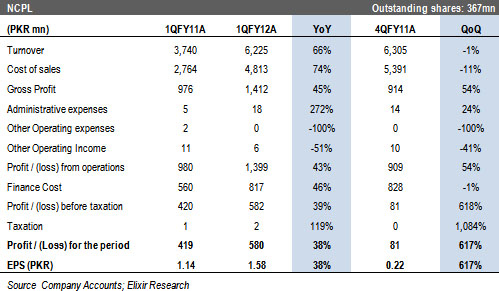

1QFY12 EPS at PKR1.58: NCPL posted PAT of PKR580mn (EPS: PKR1.58) for 1QFY12, up 38% YoY.

Operational savings propelled earnings: O&M savings for NCPL during 1Q is estimated at PKR0.47/share, up 25% YoY owing to low base effect as it was operational for 70 days during 1QFY11. Fuel savings for 1Q are estimated at PKR0.30/share.

Net spread income contributed PKR0.21: Due to rise in receivables, net spread income during 1QFY12 is estimated at PKR77mn.

Lower than expected depreciation expense during 1Q: Depreciation for 1Q was expensed at PKR233mn, 26% lower than our expectation. Annualized depreciation rate for 1Q charge was 1.7pp lower than FY11’s annual rate of 7.3% owing to lower utilization during the quarter.

BUY maintained: NCPL is currently trading at FY12 PER of 2.7x and offers a dividend yield of 29%. The scrip currently offers a healthy upside of 54% to our Jun-12 PT of PKR20/share and a real USD IRR of 19% over the remaining term of the Power Purchase Agreement. BUY!

Operational savings propelled earnings

O&M savings clocked in at PKR244mn (PKR0.47/share), up 25% YoY due to base effect as NCPL was operational for 70 days during 1QFY11. O&M cost for 1QFY12 consumed only 28% of the O&M revenues.

Fuel efficiency during 1QFY12 is estimated at 43.9%, 1.46pp down YoY due to scheduled outage of steam turbines. Due to closure of steam turbines with scheduled outage, NCPL was allowed fuel tariff adjustment during 1Q, which is estimated at 4.4%. With uptick in tariff for 1Q, NCPL realized fuel savings of PKR0.30/share.

Net spread income contributed PKR0.21

Net spread income (markup income on over dues less ST borrowing cost) during 1QFY12 is estimated at PKR77mn (PKR0.21/share), up 32% QoQ as overdue receivables increased by PKR3.6bn during 1QFY12, 56% of which was funded by ST borrowings.

Lower than expected depreciation expense during 1Q

Depreciation during 1QFY12 was charged at PKR233mn, 26% lower than our expectation of PKR314mn, which contributed to variation in earnings from our estimates. Annualized depreciation rate of 5.6% for 1Q was 1.7pp lower than FY11 depreciation rate of 7.3%. Utilization during 1Q dropped to 79%, as compared to 86% during FY11, which would likely have resulted in lower depreciation charge as useful life of plant is estimated based on generation hours.

Economic & Political News

Trade deficit up by 187% in Jul-Oct

The State Bank of Pakistan (SBP) statistics showed a growth of 187% in the deficit value compared with previous year’s period figures, standing at USD541mn. The current account deficit has swelled to USD1.56bn in 4MFY12.

Mutual Funds attract PKR66bn in 10months

The mutual fund industry is booming with money under management standing tall at PKR289bn at the end of October, representing a 17% growth over the earlier month and a huge addition of PKR66bn (30%) in the 10months since January. The growth in October was fed by money market funds. The open-end funds, which account for 127 (93%) of the total 141 mutual funds in the country posted a stellar growth of 19% (MoM) to touch PKR268bn while the closed-end funds declined by 4%, during the period, to close at the figure of PKR21bn.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By