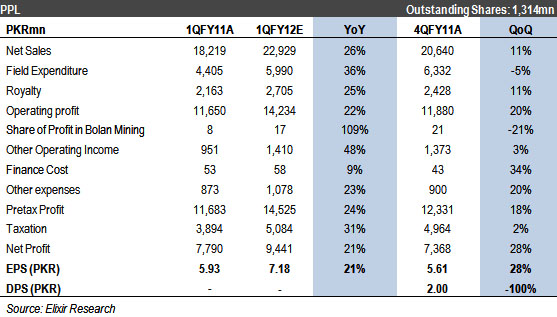

Result Expectation: PPL’s board is scheduled to meet on October 24th to consider financial result for 1QFY12. We expect the company to post an EPS of PKR7.18, up 21% YoY, driven by strong growth in oil and gas wellhead prices coupled with stellar other income.

Net Selling Price to rise 19% YoY: With 12% YoY increase in gas wellhead price and 43% YoY growth in oil wellhead, 1QFY12 Net Selling Price (NSP) will likely rise by 19% YoY. Higher share of oil in revenue mix, from 20% in 1QFY11 to 26% in 1HFY12 will also lend support.

Volumes to edge up by 5% YoY: We expect PPL’s hydrocarbon sales to edge up by 4% YoY due to 2.7% growth in gas production and 15.5% growth in oil volumes.

Field expenditure to rise 36% YoY; other income to jump 48%: Field expenditure would likely rise 36% YoY due to base effect as 1QFY11 field expenditure formed a mere 21% of full year cost. On the other hand, 30% YoY growth in average cash balances will leg up interest income by 48% YoY.

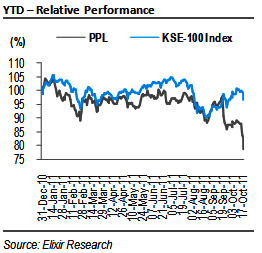

Recent price correction has made valuations attractive: PPL has corrected by 10% 2QFY12 to date, which has made valuations highly attractive. PPL currently trades at FY12 PER of 5.8x, and offers an upside of 38% to our Jun-12 PT of PKR235/share.

Net Selling Price to rise 19% YoY

1QFY12 Net Selling Price (NSP) will likely rise by 19% YoY, due to robust growth in oil and gas wellhead coupled with higher share of oil in revenue mix. Arab Light averaged USD109/bbl in 1QFY12, up 47% YoY, which would prop up oil wellhead by 43% YoY. A sharp 18% YoY growth in wellhead prices of Sui and Kandhkot would push PPL’s average gas wellhead price by 12% YoY. Share of oil in revenue mix would rise from 20% in 1QFY11 to 26% in 1QFY12, thus lending further support.

Volumes to edge up by 5% YoY

PPL managed to post 2.7% YoY growth in gas volumes despite 6% YoY decline in Sui production, mainly due to better flows from Kandhkot (+36% YoY) and Tal (+10% YoY) and tripling of flows from Latif after commencement of Latif North-01 in 2QFY11. Oil volumes remained strong, rising by 15.5% YoY in 1QFY12. We expect PPL’s hydrocarbon sales to edge up by 4% YoY in 1QFY12.

Field expenditure to rise 36% YoY; other income to jump 48%

Field expenditure would likely rise 36% YoY due to base effect as 1QFY11 field expenditure formed a mere 21% of full year estimates. Exploration cost would likely remain high in 1QFY12. While 2D seismic acquisition at 243 line km on stake adjusted basis remained roughly ¼ of 1QFY11, 3D seismic acquisition was much higher at 162sq km. 1QFY12 3D seismic acquisition was 23% higher than total 3D seismic shot during FY11. On the other hand, 30% YoY growth in average cash balances and deployment of surplus cash in higher yielding term deposits / fixed income funds will leg up interest income by 48% YoY.

Economic & Political News

Textile exports increase 25% to USD3.5bn

The country’s textile exports have registered an impressive 25% rise to USD3.466bn during the 1QFY12. Growth emanated primarily from rise in unit prices.

Attempt to keep budget deficit under limit

The federal government has slashed development spending by around PKR25bn during 1QFY12 in an attempt to keep the budget deficit under manageable limits. The government had budgeted to spend PKR75bn under the Public Sector Development Programmed (PSDP) in the 1Q but it only released PKR49.3bn during the period.

Anwar appointed new SBP governor

On a summary moved by Ministry of Finance and on the advice of Prime Minister, President Asif Ali Zardari Wednesday approved the appointment of Yasin Anwar as Governor State Bank of Pakistan, according to a press release. Yaseen Anwar has been Acting Governor (SBP with effect from 18th July 2011) since governor Hafiz H. Kardar resigned.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By