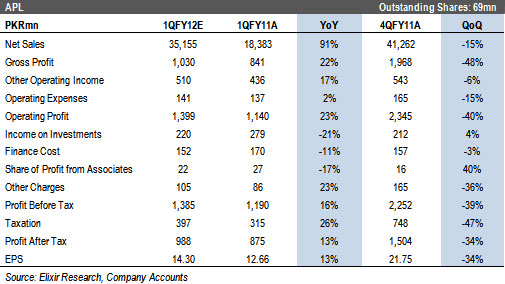

1QFY12 EPS expected at PKR14.30: APL’s board meeting for the announcement for 1QFY12 result is scheduled on October 17, 2011. We expect the company to post PAT of PKR1.4bn (EPS: PKR14.30), up 13% YoY, while down 34% QoQ mainly owing to high base effect of 4QFY11. In line with past trend we do not expect any payout with 1QFY12 result.

Volumes up 37% YoY; ↓ 12% QoQ: APL’s 1QFY12 volumes were up by 37% YoY, primarily due to HSD and HSFO which registered robust 12% and 121% YoY growth, respectively. Asphalt volumes, on the other hand, are estimated to have taken a massive dip of 47% QoQ and 11% on YoY basis during 1QFY12. However, volumetric sale during 1QFY12, were down by 12% QoQ mainly due to high base.

Margins per ton to decline by 11% YoY: APL’s realized margin on HSD at PKR0.84/liter remained 40% lower than normal margin of PKR1.39/liter during 1QFY12, which shall raze nearly PKR116mn from gross profit. With muted estimated inventory gains of PKR35mn, coupled with lesser margin on HSD, APL’s margins/ton during 1QFY12 is estimated to observe 11% YoY drop during 1QFY12.

Other income; an additional cushion: Other income which primarily comprises of commission and handling income, is expected to jump by 17% YoY on account of expected 49% YoY higher handling income during 1QFY12.

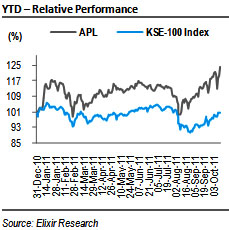

Investment perspective: We continue to rate APL as BUY as at last closing price, it offers an upside of 33% to our Jun-12 PT of PKR550/share along with a FY12 dividend yield of 8%.

Volumes up 37% YoY; ↓12% QoQ

12% and 121% YoY higher HSD and FO volumes, respectively, led APL to register 37% YoY higher volumetric sale during 1QFY12. Moreover, MS witnessed robust 85% YoY jump in its volume during 1QFY12, due to which its contribution to core profitability has increased to 12% in 1QFY12 from 9% in the same period of last year. APL’s asphalt volumes, on the other hand, took a massive hit of 47% QoQ and 11% YoY. 1QFY12 volumes, however, were down 12% on QoQ basis primarily due to high base.

Margins per ton to decline by 11% YoY

APL’s realized margin on HSD was PKR0.84/liter, which is 40% lower than normalized margin of PKR1.39/liter during 1QFY12. This shall taper an estimated PKR116mn from the 1QFY12 gross profit. Ex-depot price of HSD are based on weighted average cost of PSO import and local ex-refinery prices, which often squeeze margins of other OMCs especially in times of cheaper import by PSO. 1QFY12 EPS would likely have been higher by PKR1.11 to PKR15.41, had APL realized normalized margin on HSD. 1QFY12 inventory gains are estimated at a mere PKR35mn. With muted 1QFY12 estimated inventory gains and lesser margin on HSD, APL’s margins/ton is estimated to observe 11% YoY drop during 1QFY12.

Other income; an additional cushion

Other income which comprises of commission/handling income and late payment charges is expected at PKR510mn (up 17% YoY) or approximately PKR5/share. With 10% YoY jump in naphtha export, commission and handling income are estimated to beef up by 49% YoY during 1QFY12. APL’s penal mark up income earned on receivables and penal interest expenses on late payments have roughly moved in tandem during last four quarters. We expect this trend to continue in 1QFY12 too, since APL effectively passes on the impact of piling receivables by delaying payments to fuel supplier.

Economic & Political News

Pakistan’s 1QFY12 fiscal deficit 1.1% of GDP

Pakistan’s fiscal deficit for the first 3months of FY12 was 1.1% of gross domestic product. This compared with a deficit of 1.6% of GDP in the same period last year. The target for fiscal deficit is 4% of GDP in the year ending June 30.

Regional integration: Pakistan to cut tariffs on 233 products

In a step towards regional economic integration, Pakistan will lower tariffs on 233 products, bringing them down in the range of 0 to 5% to meet an obligation under the South Asia Free Trade Agreement (Safta). The items include pulses, vegetables, meat, fruits, cooking oil, wheat, sugar, maize, tobacco, liquor, furniture articles, used tyres, sugar manufacturing machinery, broadcasting equipment and telephone sets.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By