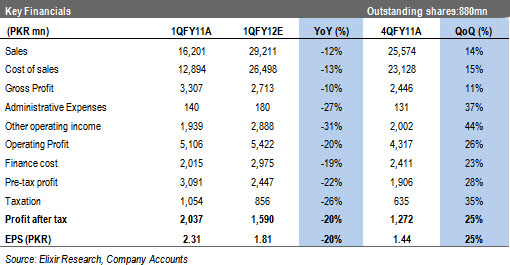

1QFY12 EPS at PKR1.81: Kot Addu Power Company is scheduled to announce its 1QFY11 financial results on October 24, 2011. We expect the company to post PAT of PKR1.6bn (EPS: PKR1.81), down 20% YoY.

Escalable component up 2.1% HoH due to indexation factor growth: Capacity Purchase Price (CPP) applicable for 1HFY12 is expected to grow by 1% HoH, mainly due to growth of 2% in escalable component coupled with 7% decline in non-escalable component. Growth in escalable component is driven by higher indexation factor, on the back of US CPI growth of 2.3% and PKR appreciation of 0.15% during 2HFY11.

Maintenance cost to remain high for 1Q: Maintenance cost for KAPCO is expected to stand at PKR301mn, up 6x YoY due to base effect as O&M cost for 1QFY11 stood at PKR43mn. We expect maintenance charges to rise during 2QFY12, as major overhauls are expected to be completed in the next quarter. Load factor for 1QFY12 is expected at 50%.

Net spread income to support earnings marginally: We expect net spread income to stand at PKR83mn (after tax earnings impact of PKR0.06/share) due to rise in average receivables during the quarter where major proportion is expected to be funded by payables.

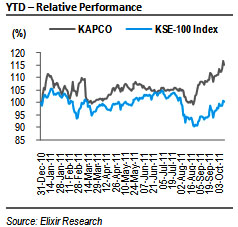

Investment Perspective: At current levels, the scrip is trading at PER of 6.3x and dividend yield of 15% for FY12. KAPCO currently offers a healthy upside of 18% to our Jun-12 PT of PKR55/share and a real USD IRR of 13% over the remaining term of Power Purchase Agreement.

Escalable component up 2.1% HoH due to indexation factor growth

Capacity purchase price (CPP) is expected to grow by a mere 1% HoH, driven by growth in escalable component amid decline in non-escalable component. Escalable component for KAPCO during 1HFY12 is expected to increase by 2% HoH primarily on the back of rise in indexation factor as unindexed escalable component has a flat tariff profile. Growth in indexation factor is mainly due to US CPI growth of 2.30% HoH, as PKR appreciated by a mere 0.15% during 2HFY11 (applicable for 1HFY12 revenues). Non-escalable component is expected to decline by 7% HoH due to declining debt profile.

Maintenance cost to remain high for 1Q

We expect maintenance charges for 1QFY12 to remain higher on YoY basis whereas flat on QoQ basis. O&M costs are expected to stand at PKR301mn, up 6x YoY due to base effect of low maintenance charges during 1QFY11 (PKR43mn). Floods during Aug-10 effected plant operations and maintenance schedules last year. Maintenance charge for KAPCO is expected to surge during 2QFY12, as overhauls associated with maintenance project are expected to be completed during the quarter. Due to limited fuel supply, we expect generation for KAPCO during 1QFY12 to stand at 1,482Gwh, at a load factor of 50%.

Net spread income to support earnings marginally

We expect the company to earn net spread income of PKR83mn (after tax earnings impact of PKR0.06/share) due to rise in average receivables during 1Q. Average overdue receivables are expected to remain higher by PKR10bn from FY11 year end levels. We have assumed 60% of the incremental receivables to be funded through fuel supplier credit whereas remaining portion shall be funded by ST borrowing and new LT financing obtained during 4QFY11.

Economic & Political News

Government revises fiscal deficit target to 4.4% from 4% for FY12

The government has revised upward the fiscal deficit projection for the current fiscal year to 4.4%, from 4%, as agreed in the budget with the International Monetary Fund (IMF), following economic performance of country during the first quarter of 2011-12. The fiscal deficit would go over 5%, in case of failure by the provinces to create PKR125bn projected budget surplus, due to unforeseen expenditure on flood, dengue and likely decline in revenue collection.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By