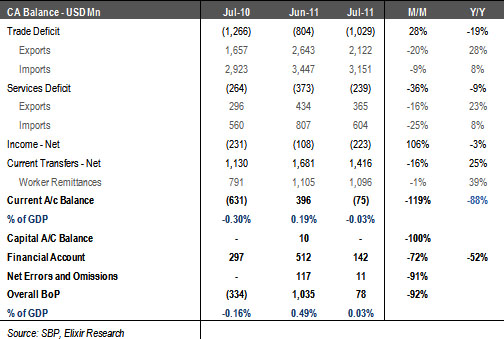

Jul-11 current account turns red on higher trade deficit: Jul-11 current account posted a deficit of USD75mn against a surplus of USD396mn in Jun-11, while overall BOP remained in surplus (USD75mn). MoM deterioration of USD471mn in current account was primarily explained by an increase of USD225mn in trade deficit on MoM basis and lower current transfers, though remittances held ground in Jul-11.

Trade account deterioration occurred despite MoM decline in oil imports: While worsening in trade account, driven by USD521mn MoM decline in exports, was expected, USD225mn contraction in trade deficit was a muted headline number given imports also contracted by USD296mn, owing to USD215mn contraction in oil imports. Textile exports have started slowing down, falling 13% MoM. Weak global economic outlook and lower cotton prices indicate likelihood of further softening in textile exports while contraction in oil imports would require correction in oil prices below USD100/bbl.

Lower machinery import is not a healthy sign: Machinery group imports at USD283m were 13% lower than FY11 monthly average. Machinery group imports have remained below FY11 monthly average for the last six months, which is not a healthy sign.

Jul-11 current account turns red on higher trade deficit

Jul-11 current account posted a deficit of USD75mn (-0.03% of GDP) against a surplus of USD396mn (+0.19% of GDP) in Jun-11. Deterioration in current account was driven by USD225mn MoM increase in trade deficit, and USD265mn MoM decline in net current transfers, although remittances held ground in Jul-11. Overall BOP remained in surplus, at USD75mn (+0.03% of GDP), though much lower than the surplus of USD1035mn (+0.49% of GDP) recorded in Jun-11. Jul-11 performance of both current account and BoP was much better when compared with Jul-10.

Trade account deterioration occurred despite MoM decline in oil imports

Trade account worsened by USD225mn on MoM basis, with Jul-11 trade deficit reaching USD1.12bn, up 26% MoM. Trade deficit was, however, still 12% lower on YoY basis. MoM rise in trade deficit was driven by 20% (USD521mn) contraction in exports while MoM contraction in imports was muted at 8%. Textile exports have started slowing down, falling 13% MoM, indicating signs of weakening on the back of lower product prices and global economic slowdown.

A discomforting factor in Jul-11 import numbers was 16% MoM contraction in oil imports which fell to USD1.17bn, which almost equates Pakistan’s average monthly oil import bill at FY11 quantity and USD100/bbl oil price. Hence worsening Jul-11 trade deficit was a muted headline number, as weak global economic outlook and lower cotton prices pose risk of further softening in textile exports while contraction in oil imports would require correction in oil prices below USD100/bbl.

Lower machinery import is not a healthy sign

Support to Jul-11 trade account also came from 8% MoM and 33% YoY decline in machinery group imports which clocked in at USD283m – an unhealthy sign for growth outlook. Jul-11 machinery imports were 13% lower than FY11 monthly average. Machinery group imports have remained below FY11 monthly average for the last six months, giving a clear indication of a downward trend in investment activity. Pakistan’s investment/GDP ratio slipped to 13.4% in FY11, as compared to an average of 20% during the 80’s, 18% during the 90’s and 18.5% during the 2000’s.

Economic & Political News

LPG policy approved by ECC

The Economic Co-ordination Committee (ECC) of the Cabinet has approved ‘LPG production and distribution policy 2011’ and agreed to the proposal of the Ministry of Water and Power for giving operational and maintenance control of four power generation companies (gencos) to the private sector O&M contractors for a period of 10 years. ‘LPG production and distribution policy 2011′ will build linkage of local LPG producer price with the C&F (Karachi) Saudi Aramco Contract Price (CP) that would enable the government to collect differential and other incidental charges in the form of petroleum levy. The new policy would enhance the local LPG producers’ price from USD100 to USD120/ton. The government would be able to generate PKR3bn additional revenue by imposing petroleum levy on LPG.

Domestic debt crosses PKR6tn mark

The stock of domestic debt shot up by PKR1.36tn to new peak level of PKR6.14tn as on June 30, 2011 as compared to PKR4.65tn on June 30, 2010.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By