2Q LPS recorded at PKR0.21: Engro Polymer & Chemicals Limited (EPCL) recently announced its financial result for 2QCY11 posting LAT of PKR139mn (LPS: PKR0.21) for the quarter against a loss of PKR269mn (LPS: PKR0.41) last year. 1HCY11 LAT reached PKR207mn (LPS: PKR0.31).

Healthy growth in gross profit despite lower VCM production: Nets Sales registered an increase of 9% YoY to PKR3.9bn during 2QCY11 mainly due to higher prices. Simultaneously, gross margins surged around 470bps YoY during 2Q mainly due to higher in-house VCM production, but still lower than expectation. Integrated PVC-Ethylene margins after deducting fuel cost, hovered around an estimated USD734/ton during 1H.

High interest cost hurting bottom-line: Finance cost was recorded at PKR371mn in 2Q, taking 1HCY11 aggregate number to PKR753mn, up 17% YoY. Resultantly, bottom-line remained negative, as higher finance cost devoured bulk of gross profit expansion.

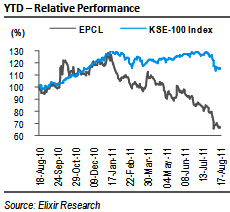

Investment perspective: At yesterday’s closing price of PKR8.0/share, the scrip trades at CY12E P/E multiple of 5.6x, and offers an upside of 43% to our Jun-12 PT of PKR11.5/share. We have assumed 0% reliance on imported VCM from CY12 onwards, which remains our key assumption to our June-12 PT of PKR12/share. 30% reliance on imports CY12 onwards would trim our CY12 EPS by 51% to PKR0.69, and cut our Jun-12 PT by 8.6% to PKR10.5.

Healthy growth in gross profit despite lower VCM production

Top-line of EPCL witnessed a surge of 9% YoY to PKR3.9bn during 2Q primarily attributable to higher prices. Demand for PVC and Caustic Soda remained stable at the level of 26k tons and 22k tons respectively. Consequently, during 1HCY11, net sales increased by 16% YoY to 7.9bn. Similar to 1Q, higher margins on integrated operations continued to provide support to bottom-line as a result of higher reliance on cheaper in-house VCM. Resultantly, gross margins surged around 470bps during 2Q. In-house VCM production stood at 21k tons in 2QCY11 as against 12k tons in 2QCY10. However, it was still lower than expectation. Integrated PVC-Ethylene margins after deducting fuel cost, hovered around an estimated USD772/ton during 2Q, while 1HCY11 average clocked in at USD734/ton, up 15% YoY. We have assumed slightly higher PVC sales (65ktons) in 2HCY11 with total CY11 off take estimate of 120k tons, while we expect integrated PVC-Ethylene margin after deducting fuel cost at USD749/ton during CY11. We estimate PVC demand to grow at 3-year (CY11-14) CAGR of 4%.

High interest cost hurting bottom-line

Higher finance cost post COD of VCM plant continues to offset operating profit growth from higher gross margins. Consequently, bottom-line during the quarter remained negative. Finance cost was recorded at PKR371mn in 2QCY11, taking 1HCY11 aggregate financial charges to PKR753mn, up 17% YoY. Higher finance cost reflects the effect of partial capitalization of finance cost during 1HCY10 as COD of the VCM plant was achieved on Sept’10.

Investment perspective

At yesterday’s closing price of PKR8.0/share, the scrip trades at CY12E P/E multiple of 5.6x, and offers an upside of 43% to our Jun-12 PT of PKR11.5/share. However, EPCL’s margins and earnings highly dependent on stability of VCM plant as PVC-Ethylene margins are approximately 3.4x of PVC-VCM margins. We have assumed integrated PVC-Ethylene margins (after deduction fuel cost) at USD749/ton during CY11. EPCL’s realized margin per ton of PVC was a mere USD557/ton during 1HCY11, due to 30% reliance on imported VCM. We have assumed 0% reliance on imported VCM from CY12 onwards, which remains a key assumption to our June-12 PT of PKR12/share. 30% reliance on imported VCM CY12 onwards would trim our CY12 EPS by 51% to PKR0.69, and cut our Jun-12 PT by 8.6% to PKR10.5.

Economic & Political News

Pakistan’s forex reserves rise to USD18.04bn

Pakistan’s foreign exchange reserves rose to USD18.04bn in the week ending Aug. 13, from USD17.97bn the previous week, a senior central bank official said on Thursday.

New levy on natural gas: Govt hopes to generate USD1.2bn through tax

The government is looking to impose a new kind of tax, Infrastructure Development Levy (IDL), a domestic source of financing, on natural gas to generate USD1.2bon to lay infrastructure of Iran-Pakistan (IP) gas pipeline project. The government had projected potential generation of PKR25bn (USD300mn)/annum by imposing this levy.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By