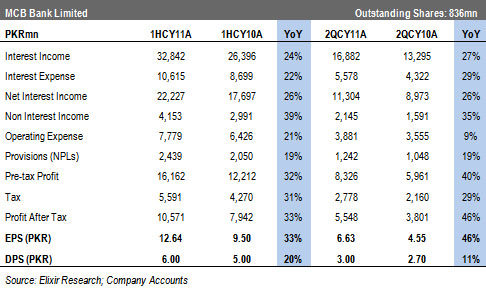

1HCY11 EPS recorded at PKR12.64: MCB bank Ltd (MCB) recently announced its 1HCY11 results where it posted earnings of PKR10.57bn (EPS: PKR12.64) against an expectation of PKR10.15bn (EPS: PKR12.14) mainly due to flood surcharge which was not charged during the period. MCB’s earnings during 1HCY11 grew by a hefty 33% YoY while on QoQ basis it reported growth of 10.4%. MCB also announced a 2nd interim dividend of PKR3/share along with the results.

Net Interest Income up 26% YoY: MCB’s net interest income during 1HCY11 increased by 26% YoY to PKR22bn against PKR18bn during 1HCY10. Increase in net interest income was mainly witnessed due to growth in deposit base resultantly increasing earning assets by approximately PKR57bn during 1HCY11.

Non Interest income witnessed robust growth of 39% YoY: The non interest income segment saw aggressive growth of 39% YoY in 1HCY11, emanating from higher capital gains, dividend income and high spreads earned on foreign currency dealings. Key driver for QoQ growth during 2Q was mainly the income on foreign currency dealing which grew 27% QoQ.

Provisioning expense up 19% YoY: MCB booked NPL provisioning of PKR1.2bn during 2QCY11 taking cumulative half yearly NPL provisions to PKR2.2bn. The bank has increased its coverage ratio to 83.6% in comparison to 80.2% in 1QCY11, as NPL accretion was a mere PKR528mn.

Effective tax rate was recorded at 33%: The effective tax rate of the bank was recorded at 33% during 2QCY11 against our estimated tax rate of 39%. This was mainly due to flood surcharge not being accounted for in 2QCY11 as MCB’s management is of the view that flood surcharge is not applicable on financial institutions.

Earnings revised and Price Target increased to PKR220: On the back of higher than expected deposit growth we have revised our CY11 and CY12 earnings estimates to PKR26.8 and PKR30.6 and have also increased our PT to PKR220. At yesterday’s closing, the scrip provides a potential upside of 26% to our Jun-12 PT of PKR220/share and is trading at a CY11E PER of 6.5x. BUY!

Net Interest Income up 26% YoY

Net interest income of MCB during 1HCY11 increased by 26% YoY to PKR22bn against PKR18bn in 1HCY10. Net Interest income grew on the back of increase in earning assets which grew by approximately PKR57bn while deposit base increased by 18% to PKR496bn during 1HCY11 against deposits of PKR419bn in 1HCY10. MCB has been able to maintain a healthy CASA of 82% during 1HCY11. During 1HCY11 the asset base of the bank grew by 11% (PKR63bn) to PKR630bn. On the other hand the investments saw an increase of 22%, increasing bank’s IDR from 49% in Dec-10 to 52% in Jun-11. The net advances of the bank have only grown by 2% during the period resultantly decreasing its net ADR from 59% in Dec-10 to 52% in Jun-11. On QoQ basis MCB’s deposit base increased by 7.3%, allowing for 3.7% increase in average earning assets, which resultantly increased net interest income by 3%.

Non Interest income witnessed robust growth of 39% YoY

The non interest income segment saw aggressive growth of 39% YoY in 1HCY11 to PKR4bn, emanating from higher capital gains, dividend income and high spreads earned in foreign currency dealings. During 1HCY11 capital gains jacked up by 270% YoY to PKR581mn, while dividend income rose 56.3% YoY to PKR352mn. Income on foreign currency dealings witnessed an increase of 76.4% in 1HCY11 to PKR486mn. On QoQ basis, 2Q growth was mainly seen in foreign currency dealing which increased by 27.3% QoQ to PKR214mn.

Provisioning expense up 19% YoY

During 2QCY11 the bank booked NPL provisioning expense of PKR1.2bn against our expectation of PKR315mn. The bank has increased its coverage ratio to 83.6% in comparison to 80.2% held last quarter, as NPL accretion stood at a mere PKR528mn during 2QCY11. On the back of higher provisions booked by MCB we have revised our full year provisioning estimates and now expect MCB to book NPL provisioning at PKR4.7bn during CY11 taking the NPL coverage to 85.3%.

Effective tax rate was recorded at 33%

We estimated tax rate of 39% for 2QCY11 due to 15% flood surcharge. However MCB did not book flood surcharge, as the management is of the view that the flood surcharge was not applicable on financial institutions. However, as disclosed by MCB’s management, if flood surcharge is accounted for, the bottom line of the bank will have an impact of PKR400bn (EPS impact of PKR0.48).

Earnings revised and Price Target increased to PKR220

On the back of higher than expected deposit growth we have revised our CY11 and CY12 earnings estimates to PKR26.8 and PKR30.6 and have increased our PT to PKR220. At yesterday’s closing, the scrip provides a potential upside of 26% to our Jun-12 PT of PKR220/share and is trading at a CY11E P/E of 6.5x respectively. BUY!

Economic & Political News

LSM posts 1.14% growth in FY11

The large-scale manufacturing (LSM) registered a YoY growth of 1.14% in FY11. The nominal improvement was mainly attributed to growth in industrial output, which grew by 3.56% during the period under review.

C/A regains deficit position in July

The current account has shown a deficit of USD75% in the first month of current financial year despite standing at surplus position in the previous month. Current account deficit decreased by 88% in July 2011 as compared to the same month of the previous fiscal year in which it stood at USD631mn. The trade deficit stood at USD1.029bn in July with USD2.12bn exports and USD3.15bn imports.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By