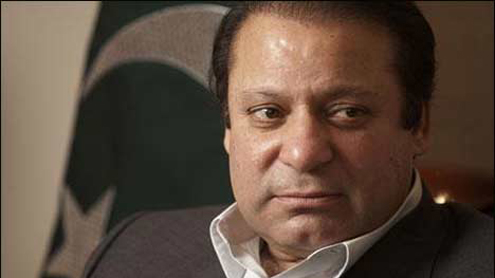

The government has made a significant change in the incentive package for the business community within 24 hours after it had been announced by Prime Minister Nawaz Sharif, by doing away with the investment limit requirement.

The government has made a significant change in the incentive package for the business community within 24 hours after it had been announced by Prime Minister Nawaz Sharif, by doing away with the investment limit requirement.

“No limit has been fixed for investment in the green field industrial and expansion projects that also include captive power plants, low-cost housing construction, livestock and mining and quarrying in Thar coal project, mining projects in Balochistan and Khyber Pakhtunkhwa and other expansion projects provided these are set up on or after Jan 1 next year,” said a statement issued by the Prime Minister’s Secretariat on Friday. Addressing leading businessmen and representatives of chambers of commerce and industry on Thursday, Mr Sharif had said the government and tax authorities would not ask questions about the source of investment if it was between Rs10 million and Rs50 billion.

Interestingly, a draft of the speech released on Thursday by the press wing of the Prime Minister’s Office said: “Investment in green field industrial projects will be immune from any probe or scrutiny of source of investment if set up on or after Jan 1, 2014, with a minimum investment of Rs25 million that created at least five jobs and then added one additional job for each five million of capital invested.” The prime minister had changed the minimum limit from Rs25m to Rs10m. He also relaxed the incentives earlier proposed for green field projects to expansion projects.

He read out a negative list of industries which would not be entitled to the incentives. However, on the demand of businessmen he said the list would be finalised later on the basis of their suggestion. The negative list included arms and ammunition, explosives, fertilisers, sugar, cigarettes, aerated beverages, cement, textile spinning mills, flour mills and vegetable ghee and cooking oils. The PM Secretariat said there would be no limit on minimum or maximum investment for benefiting from the amnesty package.

An official said the incentive packages and tax amnesty announced in the past also used to be specific in their objectives but were later changed time and again on the influence of powerful lobbies to include more sectors. “We will have to wait for a final version of the policy when it is formally notified in the Gazette of Pakistan. Until then the political government is always open to make amendments,” he said. A separate statement issued by the finance ministry said the incentives would not apply to funds accruing from crimes committed under Narcotic Substances Act 1997, Anti-Terrorist Act 1997 and the Anti-Money Laundering Act 2010.

But it did not say how this classification would be made when questions would not be asked and there would be no scrutiny of the source of investment. The statement said the multi-pronged tax incentive package was aimed at promoting investment, creating jobs, simultaneously increasing tax collection and the number of tax return filers and acknowledging leading taxpayers. The finance ministry criticised the PPP and said the stimulus package for stock exchanges introduced by its government had exempted from scrutiny the nature and source of investment in listed companies and share of public companies subject to certain conditions. But the present government has decided to shift the focus to promoting industrial growth.

It said that with the aim of increasing income tax collection and simultaneously facilitating the existing taxpayers by providing them an option to avoid tax audit, the prime minister had also allowed immunity from tax audit those taxpayers who paid 25 per cent more tax this year than paid or assessed for the previous year. The prime minister had also extended the deadline for filing tax returns to Dec 15 from Nov 30 and said those who had already filed returns would be free to revise them till the new deadline in the light of new incentives. -Dwan