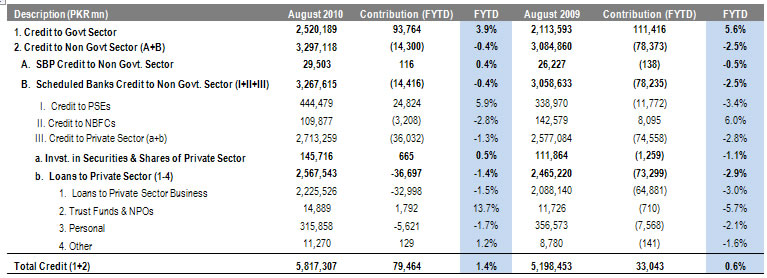

GoP’s share in overall credit offtake on the rise: With overall credit offtake rising by 1.4% FYTD up till August 2010, government’s incremental share stood at PKR94bn, increasing by 3.9% FYTD compared to 5.6% FYTD growth witnessed in the comparable period last year. Given limited external inflows and existing funds constraint, GoP has once again emerged as the main borrower to meet fiscal needs.

Private sector lending on the decline; manufacturing major contributor: Private sector credit offtake remained in the negative zone during 2MFY11 as well, albeit at lower pace. Manufacturing sector, with highest share of borrowing in the private sector, witnessed FYTD net attrition of PKR24bn compared to PKR52bn decline in 2MFY10.

Consumer financing in doldrums: Consumer financing has been in the negative zone since start of CY08, nevertheless, the quantum has reduced over time. Total decline in consumer financing during 2MFY11 stood at PKR6bn compared to PKR9bn decrease observed in 2MFY10. Crowding out to continue in the near term: Given continuous rise in government borrowing from banking channels, to bridge the fiscal gap, crowding out of private sector borrowing is expected to prevail in the near term.

GoP’s share in overall credit offtake on the rise

Limited external resources and unabated rise in fiscal needs has once again caused the GoP to emerge as main borrower of the credit during 2MFY11. The incremental contribution stood at PKR94bn, though it has significantly come down from PKR111bn addition in credit during 2MFY10. Despite IMF’s notified zero-net borrowing targets, the government relied on the State Bank of Pakistan for its financing requirements. Consequently, borrowing from banks witnessed reduction of 2.8% FYTD during 2MFY11, compared to an increase of 5.7% FYTD in the comparable period last year.

Private sector lending on a decline; manufacturing sector major contributor

Credit to non-government sector (comprising of PSEs, NBFCs and the private sector) fell by 0.4% FYTD (PKR14bn) during 2MFY11. Nevertheless, the decline was lesser compared to net reduction of PKR78bn observed during 2MFY10. This can be attributed to continued borrowing by PSEs to cover up the circular debt issue, in addition to relatively slow attrition in private sector credit demand. FY10 proved to be comparatively better for private sector lending, with 3% YoY growth in outstanding stock as against 1% YoY decrease during FY09. Manufacturing sector, with highest share of borrowing in the private sector, witnessed FYTD net attrition of PKR24bn compared to PKR52bn decline in 2MFY10.

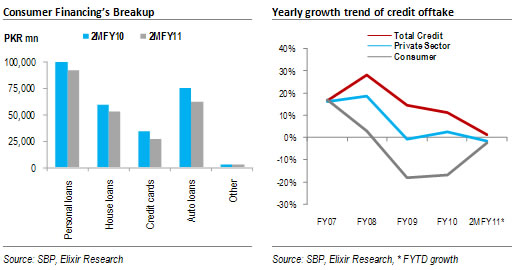

Consumer financing in doldrums

Consumer financing, severely hit by the economic slump, has been in the negative zone since start of CY08; nevertheless, the quantum has reduced over time. Total decline in consumer financing during 2MFY11 stood at PKR6bn compared to PKR9bn decrease observed in 2MFY10. Among the major consumer financing heads, Personal loans suffered a major blow with net attrition of PKR2bn, followed by Autos and Home loans with a net decline of PKR2bn and PKR950mn respectively during 2MFY11.

Crowding out to continue in near term

Given a continuous rise in the government borrowing from the banking channels (specifically from the Central Bank), to bridge the fiscal gap, the crowding out of private sector borrowing is expected to prevail in the near term and could aggravate further due to ongoing monetary tightening stance adopted by the SBP.

Canola cultivation in flood-hit areas

The SBP has launched a concessional financing and guarantee scheme, under which an amount of PKR500mn has been allocated to encourage farmers to sow canola in the flood affected areas of the country for the current Rabi season. Refinance under the scheme will be provided to banks at 5.0% per annum – while the banks will be permitted to charge a maximum spread of 3.0% p.a. from the borrowers, therefore credit to farmers will be available at 8% p.a., according to the circular. This scheme will remain valid up to October 31, 2011.

Analyst Certification

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By