I have been a member of a Mumbai club, the Bombay Gymkhana, ever since I moved to the city in the mid-1960s.

I have been a member of a Mumbai club, the Bombay Gymkhana, ever since I moved to the city in the mid-1960s.

It is essentially a sports club. Well-known Indian sports personalities like Sunil Gavaskar and Mahesh Bhupathi are members. However, it has lately acquired a more “intellectual” air, hosting talks by writers and academics. But their talks have not attracted more than a handful of members. When the Club recently announced the next speaker, everybody expected the same lukewarm response. To its great surprise there was a packed dining room and extra chairs had to be brought in.

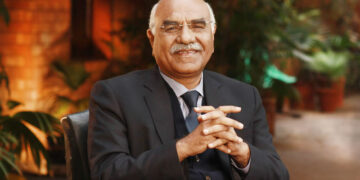

The person attracting such a large gathering was Professor Muhammad Yunus, the only Bangladeshi ever to have won a Nobel Prize, in his case for Peace. I first met him about two decades ago, when reporting for a journal devoted to sustainable development, the “Earth Times” (now sadly defunct). I was covering one of the many United Nations conferences that were being held those days on subjects like the environment, climate change, and population. Underlying these concerns was the issue of poverty.

Which is how Muhammad Yunus had come to international attention. An economist by training – he studied at Dhaka University and got his doctorate from Vanderbilt University in the USA – he decided early in his career that academics alone would not overcome the most important problem facing his country, that of grinding impoverishment. Employment and the generation of funds for the poor was the key, he concluded.This realisation came during a 1976 visit to poor households in a village near Chittagong University. The village women earned a livelihood from making bamboo furniture. But almost all their profits were eaten up by the exorbitant interest rates charged by greedy money-lenders.

When he approached banks to get them the necessary funds, he found they would not lend money without sufficient “collateral”, which the village women did not have. So, he decided to loan the money – the equivalent of just $47 – from his own pocket. To everyone’s surprise, specially the banks, the borrowers, after they had put the money to good use, promptly returned it – with some interest.Yunus had proved his point: Even poor, illiterate people had an entrepreneurial streak that could blossom if they were given sufficient the right incentives. That was the beginning of an economic revolution of sorts, not just in Bangladesh but in many other parts of the world as well, called “micro-credit”, or “micro-finance”.

In Bangladesh, it took the form of the Grameen (meaning “village”) Bank, which Yunus founded. Within a few years the Bank had expanded exponentially, mainly in the rural areas, and by 2006, it had lent as astounding $5.1 billion to 5.3 million poor people. Even more remarkably, over 95 per cent of the borrowers were women. It was a giant step in tackling poverty and his conviction that even poor people could be reliable borrowers, as well as keen entrepreneurs, had been vindicated.

In India, another remarkable individual, Ela Bhatt, in the Gujarat city of Ahmedabad, had done something very similar with humble roadside women vegetable-vendors, when she formed the pioneering “Self Employed Women’s Association” (SEWA), on much the same lines as the Grameen Bank. There are now models like the Grameen Bank in over 100 other countries. In 2006, Muhammad Yunus and his Bank were awarded the Nobel Peace Prize for “translating visions into practical actions for the benefit of millions of people, not only in Bangladesh but also in many other countries.”

His latest venture, which he talked about passionately during his visit to the Bombay Gymkhana Club is what he calls “social business”. Basically, the idea is to start a company that pays no dividends to shareholders, but ploughs all the profits back to the company whose purpose is to serve social needs. Quixotic and impractical? That’s exactly what his critics said about micro-credit. He is out, yet again, to prove them wrong.

But Yunus made a cardinal error a few years ago. He tried to enter politics. And the political establishment, feeling threatened, came down on him heavily, removing him from the Grameen Bank and ordering an inquiry into its activities. Here’s my humble advice to him. Stay away from politics. You have contributed hugely, with your unorthodox yet effective ideas, to help fight poverty in your country and to point the way to others. That is where your real genius lies. – Khaleejnews