1HFY12 EPS at PKR2.59: Hub Power Company posted PAT of PKR2.99bn (EPS: PKR2.59), up 5% YoY for 1HFY12 and also announced a robust interim dividend of PKR3/share beating market expectations. 2QFY12 EPS stood at PKR1.52, up 12% YoY.

Higher gross profit and finance cost indicate increased over dues: Variation in gross profit matched variation in financial charges which suggest that overdue receivables would likely have increased during the quarter and funded via ST borrowings. HUBC earns a positive spread of 2.5% on Narowal over dues. However, spread on hub plant over dues varies from -0.8% to 1.45%.

Project company equity to grow 10% HoH in 2HFY12: Project company equity of Hub plant is estimated to have risen by 3% HoH during 1HFY12, due to 3% built in growth in project company equity of Hub plant. However, Project company equity for 2HFY12 is expected to increase by 10% HoH, mainly driven by inbuilt growth of 4% and 5% growth in PCE indexation factor.

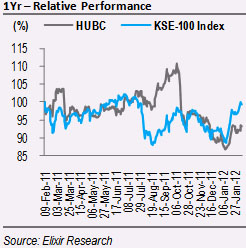

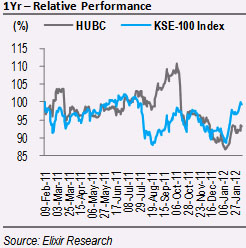

Weak price performance during CY12 to date offers an entry opportunity: HUBC has underperformed the market by 3.7% during CY12 to date, as it has risen by 4.6%, where KSE-100 index gained 8.3%. Robust interim dividend and final tariff would likely address concerns related to company’s performance. HUBC is currently trading at FY12 PER of 6.0x, offering FY12 dividend yield of 17%. The scrip currently offers an upside of 42% to our Dec-12 PT of PKR51/share and a real USD IRR of 20% over the remaining term of the power purchase agreements. BUY!

Higher gross profit and finance cost indicate increased over dues

Gross Profit and finance costs during 2QFY12 were higher than our estimates by PKR0.38/share. Variation in gross profit and finance cost by similar amount suggests that overdue receivables were funded with short term borrowings. When HUBCO funds its overdue receivables with ST borrowing, markup from WAPDA/NTDCL is recorded in top line, which is offset by higher finance cost.

Overdue receivables associated with Hub plant receive markup at discount rate (currently 12%) + 2% from WAPDA. Markup on hub plant related ST borrowing ranges between a spread of 0.75% to 3% above one month KIBOR (currently 11.8%). Overdue receivables of Narowal are entitled to penal markup at 3MKIBOR + 4.5% from NTDCL. Markup on ST borrowing for Narowal is + 2% above 3M KIBOR (currently 11.7%). This arrangement suggests that HUBC would earn a spread of 2.5% on Narowal over dues. However, spread on Hub plant over dues (higher than Narowal) would vary depending on net cost of ST borrowing realized and vary in the range of -0.8% to 1.45%.

Project company equity to grow 10% HoH

Project company equity component of Hub plant tariff is estimated to have risen by 3% HoH during 1HFY12, due to 3% HoH built in growth in project company equity of Hub plant as average PKR/USD exchange rate remained flat during 2HFY11 (applicable for 1HFY12 revenues). However, Project company equity for 2HFY12 is expected to rise by 10% HoH, primarily on the back of 4% HoH growth in unindexed project company equity and 5% growth in indexation factor. Growth in indexation factor is expected on the back of 2% PKR deprecation during 1HFY12 and US CPI growth of 3% during CY11.

Economic & Political News

Pakistan’s forex reserves fall to USD16.69bn

Pakistan’s foreign exchange reserves fell to USD16.69bn in the week ending Feb 3, compared with USD16.87bn the previous week, the central bank said on Thursday

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By