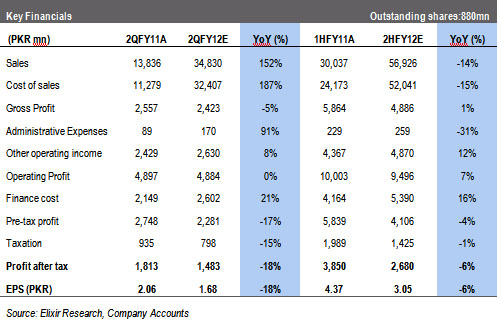

Result expectation: Kot Addu Power Company is scheduled to announce its 1HFY12 financial results on February 15, 2012. We expect the company to post PAT of PKR2.68bn (EPS: PKR3.05), down 6% YoY and pay an interim dividend of PKR3/share. 1QFY12 EPS is expected at PKR1.68, down 18% YoY.

CPP component for 2QFY12 up 2% YoY: Capacity Purchase Price (CPP) applicable for 2QFY12 is expected to increase by 2% YoY, driven by 4% rise in escalable component which houses equity holders’ returns amid 11% drop in non-escalable (debt) component of tariff. Rise in escalable component is expected on the back of 1% PKR depreciation and US CPI growth of 2.8% during FY11 (applicable for 1HFY12 revenues).

Net spread income to contribute PKR0.14/share: Net spread income on overdue receivables for the quarter is expected at PKR196mn (after tax earnings impact of PKR0.14/share), down 57% YoY mainly due to increased reliance on expensive fuel supplier credit.

Maintenance project completion to boost efficiency: We expect utilization of KAPCO to remain low at 50%, on account of maintenance project completion during the quarter. KAPCO is expected to realize efficiency gains during 2HFY12 onwards and thus FY13 EPS/DPS would increase by 19%/24%.

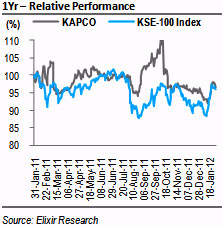

Investment Perspective: KAPCO is currently trading at FY12 PER of 5.8x and offers dividend yield of 16% for FY12. The scrip currently offers an upside of 35% to our DDM based Dec-12 PT of PKR56/share and real USD IRR of 15% over the remaining term of the PPA.

CPP component for 2QFY12 up 2% YoY

We expect Capacity Purchase Price (CPP) for 2QFY12 to rise by 2% YoY, primarily on the back of 4% rise in escalable component as non-escalable debt component of tariff is expected to decline by 11% YoY. Escalable component houses shareholders’ returns of IPPs. Indexation factor applicable for 2QFY12 was the major contributor to the increase in escalable component as KAPCO has flat tariff profile. Indexation factor growth of 4% was driven by 1% PKR depreciation and US CPI growth of 3% during FY11 (applicable for 1HFY12 revenues).

Net spread income to contribute PKR0.14/share

Overdue receivables of KAPCO are expected to have remained at 1QFY12 level of PKR65bn, as the company received PKR8-10bn monthly during the quarter. We thus expect net spread income on overdue receivables to clock in at PKR196mn (after tax earnings impact of PKR0.14/share), down 57% YoY. Decline in net spread income is expected on the back of increased reliance on fuel supplier credit with exhaustion of bank borrowing limits. KAPCO earns a positive spread of 1-2% on funding overdues via ST borrowings as compared to using fuel supplier credit as source of funding where it earns a negative spread of 2%.

Maintenance project completion to boost efficiency

Generation for the quarter is expected to remain low at 1,469Gwh, at a load factor of 50% due to completion of efficiency/maintenance project. Maintenance project completion would improve efficiency of KAPCO by 0.16pp (0.78gms/kwh) and thus KAPCO is expected to realize strong earnings growth during FY13. FY13 EPS and DPS are expected to grow at 19% and 24% respectively.

Economic & Political News

Fuel prices rise by up to 6%

Ogra has raised the per litre price of petrol by PKR5.37, High Speed Diesel (HSD) by PKR4.64, High Octane Blending Component (HOBC) by PKR6.29, kerosene oil by PKR2.78 and Light Diesel oil (LDO) by PKR3.43. The new per-litre price of petrol is PKR94.91, kerosene oil PKR92.02, HOBC PKR118.20, LDO PKR90.21 and HSD PKR103.46.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By