11MFY11 deposit expansion decreased to 6%: Banks’ deposit base grew by 5.7% to reach PKR5.4trn during 11MCY11, lower than the growth of 10.8% in the same period last year.

Credit contraction of 3.9% during 11MCY11: Advances declined by 3.9% against a growth of 3.1% during the same period last year. Traditional demand for commodity financing (for cotton procurement in particular) will help pick up advances in Dec11, increasing CY11 advances by to 1-2% YoY compared to 7% last year.

Outlook: Low risk appetite will likely keep banks’ preference for the government securities intact for the time being given the non-conducive macro environment the sector’s aim to contain credit cost which will lead to a cautious lending attitude.

11MCY11 deposit expansion decreased to 6%

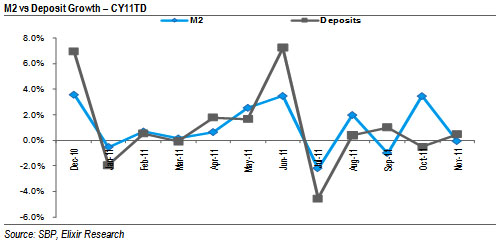

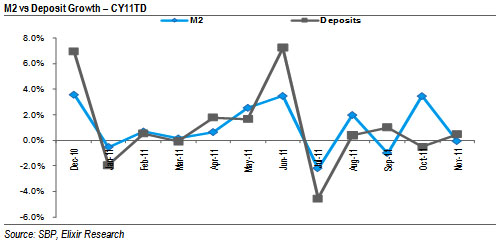

On the liability side, banks’ deposit base, the biggest source of funding for banks in Pakistan and inextricably linked to their liquidity position, grew by 5.7% to reach PKR5.4trn during 11MCY11, lower than the growth of 10.8% in the same period last year. Lower growth in deposits in 2011 is largely attributed to decline in monetary expansion on the back of 1) Net Foreign Assets (NFA) rising by only 6% during the period compared to 16% during 11MCY10 and 2) Net Domestic Assets (NDA) increasing by 8% during 11MCY11 against 10% in the same period last year. Slower M2 growth (7% during 11MCY11 against 10% last year) is

expected to lead to deposit growth of 10% for CY11 compared to 18% last year.

In general, deposits of banks face stiff competition posed by instruments of the National Savings Schemes (NSS). As a result, low returns on deposits continue to hurt deposit growth.

Credit contraction of 3.9% during 11MCY11

Advances declined by 3.9% YoY against a growth of 3.1% during the same period last year. Traditional demand for commodity financing (for cotton procurement in particular) will help pick up advances in Dec-11. In addition, sequential increase in working capital requirement from the corporate sector is also expected to add value to loan book. These factors lead us to assume a 1-2% growth outlook in advances for the current year against 7% last year.

Investments, on the other hand, continued to consume major part of the generated liquidity. Banks’ investment during the period under review increased by a massive 40.9% against 14.9% growth posted in 11MCY10 primarily on the back of conversion of PKR391bn of PSE debt into treasury bills and PIBs.

Outlook

Low risk appetite will likely keep banks’ preference for the government securities intact for the time being. Furthermore, non-conducive macro environment does not warrant a strong credit offtake growth in the near-term; while banks aim to contain credit cost which will lead to a cautious lending attitude.

Economic & Political News

Pakistan forex reserves rise to USD16.69bn

Pakistan’s foreign exchange reserves inched up to USD16.7bn in the week ending December 9 compared with USD16.7bn in the previous week because of an increase in the reserves of commercial banks. Reserves held by the State Bank of Pakistan (SBP) fell to USD12.8bn, compared with USD12.9bn the previous week. Reserves held by commercial banks rose to USD3.9bn, compared with USD3.8bn from the previous week.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By