Higher oil prices during 1HFY12 → strong 2H wellhead prices: Arab Light has so far averaged USD108/bbl during 2QFY12, taking Jun-11 to Nov-11 average to USD109/bbl, 5% higher than the six months preceding it. 2HFY12 wellhead prices for PPL, which tracks oil prices with a six month lag, would thus be up 4% HoH, which would yield a YoY increase of 17%.

Our estimates remain conservative due to lower oil price assumption: We have assumed average Arab Light price of USD90/bbl during 2HFY12 and USD93/bbl for FY13. Despite sequentially lower oil price assumption, our 2HFY12 EPS would still form 51% of full year estimates. Our FY12/13 estimates would be subject to upside incase oil price sustains current levels.

News flow on partner operated blocks to provide impetus ahead: With initial flows from Nashpa-02 already announced, clarity on final flow numbers post testing completion would be a key trigger, followed by completion of Nashpa-03, both likely to fall within FY12. Lundo-01, an exploratory well in Gambat, is also approaching completion, while commencement of Makori East – 01 from 2HFY12 and further drillings in Tal block would also be closely tracked by investors.

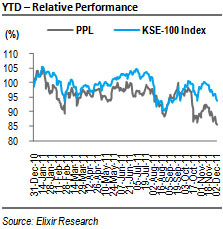

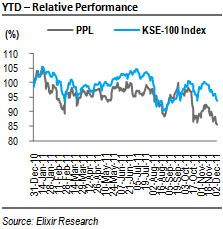

Recent correction provides an ideal entry opportunity: Against a 4% decline in KSE-100 index, PPL has corrected by 11% in 2QFY12 to-date, on fears of supply increase post planned secondary public offering of 33mn shares by GoP. Recent underperformance provides an ideal entry opportunity in our view, given that PPL trades at cheapest FY12 PER of 5.6x amongst the listed E&Ps. Our Jun-12 PT of PKR235/share offers an upside of 39%. BUY

Higher oil prices during 1HFY12 → strong 2H wellhead prices

Arab Light has so far averaged USD108/bbl during 2QFY12, taking Jun-11 to Nov-11 average to USD109/bbl, 5% higher than the six months preceding it. Since wellhead prices in Pakistan are fixed semi annually, based on average oil prices that prevailed during the first six months of the preceding seven months, Jun-11 to Nov-11 oil prices would determine wellhead prices for 2HFY12. We expect 2HFY12 wellhead prices for PPL to rise 4% HoH, which follows a strong 12% HoH increase during 1HFY12. As a result 2HFY12 wellhead prices for PPL would rise 17% YoY.

Our estimates remain conservative due to lower oil price assumption

We have remained conservative in our oil price assumption, factoring in average Arab Light price of USD90/bbl for 2HFY12 and USD93/bbl for FY13. Despite sequentially lower oil price assumption, our 2HFY12 EPS would still form 51% of full year estimates. While we expect FY13 EPS growth at 9% YoY, driven by 5% volume growth, our FY12/13 estimates would be subject to upside incase oil price sustains current levels.

News flow on partner operated blocks to provide impetus ahead

We expect strong news flow for PPL during 2HFY12 which should keep the scrip in limelight. Already announced initial flows from Nashpa-02 were encouraging at 3,370bpd oil and 11mmcfd of gas from Datta Sandstone, which was the first of the six targeted formations. We initially expected Nashpa-02 to yield 4,000 bpd oil and 13mmcfd gas, however, strong flows from the first formation raise likelihood of better yield from the well.

Nashpa-03 is likely to be completed during FY12 as the well has almost reached its target depth. An exploratory well, Lundo-01, in OMV operated Gambat block (PPL stake: 24%), is also approaching completion. Commencement of Makori East – 01 from 2HFY12 and further drillings in Tal block (completion of Makori East – 02 and Manzalai – 09 and commencement of drilling in Maramzai – 02 and Mamikhel – 02) would also be closely tracked by investors.

Recent correction provides an ideal entry opportunity

Against a 4% decline in KSE-100 index, PPL has corrected by 11% in 2QFY12 to-date, on fears of supply increase post planned secondary public offering of 33mn shares by GoP. Recent media reports indicated that PPL’s offering would be completed by Jan-12 which should ease concerns of investors regarding offer price undercutting existing share price. We see little likelihood of a significant discount to current market price as PPL offering shall have a negligible fiscal impact. Recent underperformance provides an ideal entry opportunity in our view, given that PPL trades at cheapest FY12 PER of 5.6x amongst the listed E&Ps, in comparison to 7.98x for OGDC and 6.21x for POL. Our Jun-12 PT of PKR235/share offers an upside of 39%. BUY

Economic & Political News

Govt makes huge borrowing from scheduled banks

The government’s borrowing stood at PKR44.84bn from the central banks during July to Nov-11 compared with PKR251bn during the same period of last year. Its borrowing from the commercial banks stood at PKR653.74bn during July-Nov compared with PKR54bn during the same period last year.

Only 25% PSDP releases made in five months

The government seems to have adopted a tight policy to release development funds to contain the fiscal deficit as only 25% PSDP releases have been made during five months of fiscal year. Government released PKR74bn during five months as against PKR290bn allocated.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By