9MFY11 EPS expected at PKR33.23: POL is scheduled to announce its financial result for 9MFY11 on April 19. We expect the company to announce 3QFY11 earnings at PKR2.7bn (EPS: PKR11.25), up 17% YoY, which shall take 9MFY11 earnings to PKR7.9bn (EPS: PKR33.23), 40% higher on YoY basis. Our estimate for 3QFY11 assumes an expense of PKR350mn for possible write off of MG-01. Incase MG-01 is not expensed, our 3QFY11 EPS shall rise to PKR11.93, and 9MFY11 EPS shall rise to PKR33.90.

Flattish volumes on QoQ basis; base effect driving YoY growth: POL’s oil volumes trimmed 11bpd from the previous quarter to 7301bpd during 3QFY11 while gas gained 1mmcfd to 87 mmcfd. On YoY basis, volumes shall be up significantly, with gas up 14% and oil up 7%.

Higher oil prices to drive NSP up 11% YoY: Higher oil prices shall drive up net realized price (NSP) for oil by 26% YoY to USD88/bbl, whereas gas NSP shall remain flattish due to high share of capped gas fields.

Exploration cost to rise due to dry well and higher seismic: We expect 3QFY11 exploration cost to more than triple from the 2Q level to PKR600mn, as we expect PKR250mn in seismic cost and PKR350mn in dry well expense on account of MG-01. While MG-01 is a suspended well, a similar case with Makori West – 01 last year led POL to expense the well cost.

Other income to fall 54% QoQ: 3QFY11 other income shall fall 54% QoQ, due to lower dividend income from long term investments and shall be the major factor behind QoQ earnings decline, besides higher exploration cost. 3QFY11 other income shall be up 48% YoY.

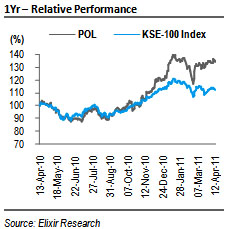

Earnings revised; PT maintained: Higher oil prices have led us to revise FY11 EPS by 1% to PKR45.1, whereas we trim FY12-13 EPS by 4% after adjusting for lower production from Pindori. At yesterday’s closing, POL trades at FY12 PER of 6.8x and offers FY12 dividend yield of 11%. The scrip offers an upside of 14% to our Dec-11 PT of PKR370/share. BUY!

Flattish volumes on QoQ basis; base effect driving YoY growth

POL’s hydrocarbon sales will likely remain flattish on QoQ basis with oil volumes trimming 11bpd QoQ to 7301bpd during 3QFY11 while gas volumes shall edge up marginally by 1mmcfd from the previous quarter to 87 mmcfd. YoY basis comparison shall continue to demonstrate growth with 3QFY11 gas volumes up 14% and oil volumes up 7%.

Higher oil prices to drive NSP up 11% YoY

With oil prices averaging USD102/bbl during 3QFY11, up 21% QoQ, we expect net realized price (NSP) for oil to jump 18% QoQ to USD88/bbl. On YoY basis, 3QFY11 oil NSP shall post a 26% growth. However gas NSP shall remain flattish at USD2.95/mmcf, down 1% YoY and 3% QoQ, due to high share of capped gas fields. Share of capped fields in POL’s gas revenues has been rising post Tal expansion with capped gas wellhead prices. Capped gas fields share in revenues rose from 74% in 3QFY10 to 81% in 2QFY11, further rising to 83% in 3QFY11. While rising revenues from capped fields is reducing correlation of POL’s gas NSP with oil prices, it is also depressing the realized prices, as current wellhead prices for capped fields are lower than those for uncapped fields.

Exploration cost to rise due to dry well and higher seismic

We expect 3QFY11 exploration cost to more than triple from the previous quarter’s level to PKR600mn, as we expect PKR250mn in seismic cost and PKR350mn in dry well expense on account of MG-01. While MG-01 is a suspended well, a similar case with Makori West – 01 last year led POL to expense the well cost. POL shot 142 line km of 2D seismic during 3Q as compared to 113 line km during 2QFY11, which underpins our expectation of PKR250mn on account of seismic cost, up 28% QoQ.

Other income to fall 54% QoQ

We expect 3QFY11 other income at PKR352mn, up 48% YoY but 54% lower on QoQ basis. QoQ decline is expected as POL shall book a meager PKR56mn in dividend income, reflecting half yearly dividend from APL. Dividend income was a stellar PKR481mn during 2QFY11. Lower 3Q dividend income shall be the major reason behind 10% QoQ earnings attrition for POL in 3QFY11, besides steep escalation in exploration cost.

Earnings revised; PT maintained

Higher oil prices have led us to revise FY11 EPS by 1% to PKR45.1, whereas we trim FY12-13 EPS by 4% after adjusting for lower production from Pindori. Our FY12/13 expected EPS, which now stand at PKR48.1 & PKR53.2, reflect oil price of USD90/bbl and USD93/bbl respectively. Current oil price (USD120/bbl) implies 17-19% upside for FY12/13 EPS. At yesterday’s closing, POL trades at FY11/12 PER of 7.2x/6.8x and offers FY11/12 dividend yield of 10%/11%. The scrip offers an upside of 14% to our Dec-11 PT of PKR370/share. BUY.

Economic & Political News

GoP to issue PKR130bn TFC to pay off circular debt

The government has decided to TFC of PKR130bn during the current fiscal year to pay off a major part of energy sector circular debt. The government will make a series of book adjustments on account of its share of dividends receivable from SOEs and unpaid discounts on local crude oil production, which shall be adjusted against payables on behalf of provincial governments and federal departments on account of electricity arrears. With the injection of PKR130bn to be raised through TFCs, securitization of government dividends, petroleum levy and other taxes, the circular debt can be reduced to a negligible level, although the electricity tariff increases will be required to forestall re-emergence of the circular debt going forward.

Production decline from Qadirpur; gas suspension to fertilizer industry may raise urea prices

Sources in the Ministry of Industries and Production (MoIP) fear that the suspension of gas supplies to the fertilizer plants by Sui Northern Gas Pipeline Limited (SNGPL) might result in increase in fertilizer prices ahead of the kharif season, due to product shortage on account of lower production. Production from Qadirpur gas field has fallen steeply by 106mmcfd during the last nine weeks to 454mmcfd for the week ending April 5, due to reported fault in compressors recently installed.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By