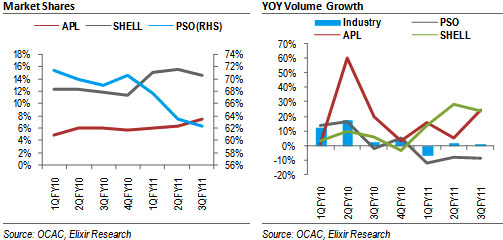

Industry volumes up 1% YoY in 3QFY11: 3QFY11 has been an ordinary quarter for OMCs as industry’s oil volumes, based on provisional data, managed to edge up 1% YoY, helped primarily by 12% YoY growth in Feb-11, as Mar-11 volumes were up a mere 2% YoY. Volumes for 9MFY11 fell 2% YoY.

Weak HSD demand a major drag on volumes: While lower CNG availability lifted Mogas volumes by 12% YoY in 3QFY11, with overall volumes further helped by 8% YoY growth in jet fuels, weak HSD volumes, down 5% YoY, was a major drag on overall industry’s sales. 3QFY11 FO volumes were up 3% YoY.

PSO – lackluster volume performance continues: Lackluster volume performance continued for PSO in 3QFY11 with overall volumes down 9% YoY whereas 9MFY11 volumes also fell 9% YoY. PSO’s 3Q volumes were the lowest in the last four years, mainly due to weak FO and HSD sales.

Strong Volumes for SHEL and APL: Highest ever quarterly FO and Mogas sales helped APL post 25% YoY growth in volumes during 3QFY11, despite 3% YoY decline in HSD sales. Volumes for SHEL were up 23% YoY due to 35% YoY growth in Jet Fuels and low base effect of negligible FO sales last year.

Industry volumes up 1% YoY in 3QFY11

With Mar-11 oil volumes clocking in a 2% YoY growth, 3QFY11 volume growth for OMCs settled at an unappealing 1%, helped primarily by 12% YoY growth in Feb-11. While 3QFY11 has been a roller coaster ride, with a strong Feb-11 and muted Mar-11 following a dismal Jan-11 where volumes fell 8% YoY, a close analysis reveals that base effect was behind wide swings in volume growth. Last year, Jan-10 volumes were up 14% YoY, followed by 10% YoY decline in Feb-10, while Mar-10 sales grew 3% YoY. Volumes for 9MFY11 now show a 2% YoY decline.

Weak HSD demand a major drag on volumes

While lower CNG availability, coupled with higher vehicle population and greater

consumption by electricity generators, lifted Mogas volumes by 12% YoY in 3QFY11, followed by 8% YoY growth in jet fuels, weak HSD demand continued to dampen overall industry volumes. 3QFY11 HSD volumes trimmed 5% YoY, a result of dismal economic activity. FO sales during the quarter were up 3% YoY, as improvement in systems efficiency – through higher utilization of efficient electricity generation capacities – has somewhat muted the impact of greater electricity generation on FO.

PSO – lackluster volume performance continues

Lackluster volume performance continued for PSO in 3QFY11 with overall volumes down 9% YoY with 9MFY11 also showing a similar (9% YoY) decline. PSO has posted negative YoY volume growth in four of the last five quarters, posting the lowest 3Q volumes in the last four years during 3QFY11, and market share on a continuous decline since 4QFY10. 3QFY11 market share for PSO (energy products) stood at 62%, 9pp lower than 71% during 4QFY10. Weak volumetric growth for PSO is primarily because of lower HSFO volumes as electricity generation mix of the country is moving away from the inefficient govt. owned capacities which purchase FO from PSO. Recently commenced FO based private sector power plants procure their furnace oil from either of SHELL or APL (along with some unlisted OMCs as well) – both witnessing stellar FO volumes recently. While PSO’s FO market share plunged to 73% in Feb-11 (3QFY11: 75%), it recouped to 78% in Mar-11, as higher mercury would likely have stepped up power demand and subsequently the utilization levels at govt. owned power generation capacities.

Strong volumes for SHEL and APL

Highest ever quarterly FO and Mogas sales helped APL post 25% YoY growth in volumes during 3QFY11, despite 3% YoY decline in HSD sales. APL’s FO sales witnessed 62% YoY rise whereas Mogas volumes were up 102% YoY. Volumes for SHEL were up 23% YoY due to 35% YoY growth in Jet Fuels and growth of 7x in FO sales due to low base effect of negligible sales last year.

Economic & Political News

CPI inflation up by 14.2%

The CPI inflation soared by 14.20% during July-March period of 2010-11 over the same period of last year, reflecting a strong trend of increase in food prices, according to Federal Bureau of Statistics (FBS). Official figure of Consumer Price Index (CPI), released by the FBS at a news briefing, showed 1.48% increase in the monthly inflation in March 2011 over previous month, and 13.16% over the same month of last year.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By