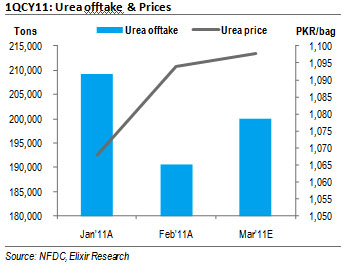

Higher Urea prices to offset lower volumetric sales in 1QFY11; Urea prices, excluding post Mar 15 GST impact, averaged PKR1,020/bag during 1QCY11, up 25% YoY. Volumetric sales on the other hand, will likely fall 4% YoY in 1Q due 12% gas curtailment.

Higher dividend income from FFBL to support 1Q earnings: FFC will likely book PKR1.7bn in dividend income from FFBL during 1QFY11, reflecting full year CY10 dividend, up 22% YoY, a key contributor to expected YoY EPS growth during 1Q. Our initial estimates suggest 1QCY11 EPS for FFC between PKR4.7-4.9, up 46%-52% YoY, while we expect 1st interim dividend at PKR4.0/share.

Earnings and PT revision: We have revised up our CY11-13 earnings forecast for FFC by 11%-12% mainly on the back of fertilizer price revision. We expect Urea margins to increase by 35% YoY to USD240/ton in CY11. As a result, our Dec-11 PT for FFC is revised upwards to PKR136/share. At last closing price, the scrip trades at CY11E P/E multiple of 8.0x and offers CY11E dividend yield of 11%.

Higher Urea prices to offset lower volumetric sales in 1QFY11

Urea prices, excluding post Mar 15 GST impact, averaged PKR1,020/bag during 1QCY11, up 25% YoY. Imposition of 17% GST led prices to rise by 17% to PKR1,200/bag in Mar-11. Volumetric sales on the other hand, will likely fall 4% YoY in 1Q due 12% gas curtailment. FFC’s urea sales during Jan-Feb’11 were down 4% YoY. Hence, we remain firm with our full year volumetric decline expectation of 10% YoY and full year anticipated top-line growth of 11% YoY for FFC.

Higher dividend income from FFBL to support 1Q earnings

FFC will likely book PKR1.7bn in dividend income from FFBL during 1QFY11, reflecting full year CY10 dividend, up 22% YoY, a key contributor to expected YoY EPS growth during 1Q. CY10

final payout from FFBL was up 55% YoY and shall be the key contributor to 1QCY11 EPS growth. 1QCY11 dividend income shall form 49% of our full year expected dividend income for FFC. Our initial estimates suggest 1QCY11 EPS for FFC between PKR4.7-4.9, up 46%-52% YoY, while we expect 1st interim dividend at PKR4.0/share.

Earnings and PT revision

Revising our fertilizer price assumption we have revised our CY11-13 earnings forecast for FFC by 11%-12%. We expect Urea margins to increase by 35% YoY to USD240/ton in CY11. As a result, our Dec-11 PT for FFC is revised upwards to PKR136/share. At last closing price, the scrip trades at CY11E P/E multiple of 8.0x and offers CY11E dividend yield of 11%.

Economic & Political News

Parco board Okays Khalifa oil refinery project

The Board of Directors of the Pak Arab Refinery Limited (Parco) on Wednesday gave the go ahead to sign a ‘participation agreement’ with Abu Dhabi oil giant, International Petroleum Investment Company (IPIC), to kick off work on the multi-billion dollars Khalifa Coastal Oil Refinery (KCR) project in Balochistan. The proposed refinery will have a capacity to refine 13mn tons of petroleum products per annum and the government of Pakistan has allotted 1000 acres of land for the project. The proposed Khalifa Refinery with an output capacity of 250,000 barrel per day (bpd) is expected to cost USD6bn. IPIC and other UAE government institutions will have the majority shareholding ie 74%, whereas Parco will have 26% shares. Parco itself is a joint venture between Pakistan and UAE.

IMF to be briefed on taxation measures next month

Pakistan will discuss the recent taxation measures taken to meet revenue targets by the government with the International Monetary Fund (IMF) during the spring meetings (April 11-16) in Washington.

Analyst Certification:

The research analyst(s) denoted AC on the cover of this report, primarily involved in the preparation of this report, certifies that (1) the views expressed in this report accurately reflect his/her personal views about all of the subject companies/securities and (2) no part of his/her compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this report.

Disclaimer

The report has been prepared by Elixir Securities Pakistan (Pvt.) Ltd and is for information purpose only. The information and opinions contained herein have been compiled or arrived at based upon information obtained from sources, believed to be reliable and in good faith. Such information has not been independently verified and no guaranty, representation or warranty, expressed or implied is made as to its accuracy, completeness or correctness. All such information and opinions are subject to change without notice. Descriptions of any company or companies or their securities mentioned herein are not intended to be complete and this document is not, and should not be construed as, an offer, or solicitation of an offer, to buy or sell any securities or other financial instruments.

Research Dissemination Policy

Elixir Securities Pakistan (Pvt.) Ltd. endeavors to make all reasonable efforts to disseminate research to all eligible clients in a timely manner through either physical or electronic distribution such as mail, fax and/or email. Nevertheless, not all clients may receive the material at the same time.

Company Specific Disclosures

Elixir Securities Pakistan (Pvt.) Ltd. may, to the extent permissible by applicable law or regulation, use the above material, conclusions, research or analysis in which they are based before the material is disseminated to their customers. Elixir Securities Pakistan (Pvt.) Ltd., their respective directors, officers, representatives, employees and/or related persons may have a long or short position in any of the securities or other financial instruments mentioned or issuers described herein at any time and may make a purchase and/or sale, or offer to make a purchase and/or sale of any such securities or other financial instruments from time to time in the open market or otherwise. Elixir Securities Pakistan (Pvt.) Ltd. may make markets in securities or other financial instruments described in this publication, in securities of issuers described herein or in securities underlying or related to such securities. Elixir Securities Pakistan (Pvt.) Ltd. may have recently underwritten the securities of an issuer mentioned herein.

Other Important Disclosures

Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk. Foreign currency denominated securities is subject to exchange rate fluctuations which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

Contributed By