Flimsy exports dragging earnings in 1HFY11: Lucky cement’s 2QFY11 earnings of PKR734mn (EPS: PKR2.27) was up 0.9% QoQ whereas 1HFY11 EPS of PKR4.52 was down 23% YoY basis. Decline in earnings was primarily due to decline in overall dispatches. Dispatches fell 12% YoY in 1HFY11 on the back of lower export volumes which contracted 30% YoY.

Local dispatches show vigor… LUCK’s 2QFY11 local dispatches were up by 23% YoY while 1HFY11 dispatches clocked an increase of 13% YoY. Growth in local dispatches was primarily due to higher retention prices as compared to exports. We expect LUCK’S local dispatches to grow by 8% in FY11.

… while export dispatches take a beating: Sluggish construction activities coupled with oversupply of cement in the Middle East caused LUCK’s 1HFY11 export dispatches to fall by 30% YoY. With LUCK being more leveraged to exports relative to its peers, we expect LUCK’S export dispatches to decline by 35% YoY to 2.2mn tons in FY11.

Rising selling prices offsetting cost increases and pushing EBITDA margins upwards: While 29% YoY increase in cash cost per ton (COGS – depreciation + SG&A) during 2QFY11 outpaced 25% YoY rise in average net retentions, absolute increase in retentions still outpaced costs by PKR 106/ton. We expect 3Q EBITDA margins to rise 12% QoQ due to cheaper coal inventories.

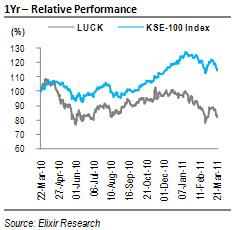

Investment perspective: DCF based valuation, using risk free rate of 14%, market risk premium of 6%, and a beta of 1.2 for LUCK, yields Dec-11 Price Target of PKR85/share. We have used a terminal growth rate of 4%. At yesterday’s closing of PKR 64/share, LUCK is trading at FY11/12 PER of 6.5x/6.0x. BUY!

Local dispatches show vigor…

LUCK’s 2QFY11 local dispatches were up by 23% YoY while 1HFY11 dispatches clocked an increase of 13% YoY. Growth in local dispatches was primarily due to higher retention prices as compared to exports, which led LUCK to focus more on local sales, as evident in market share increase. LUCK enhanced its share in domestic market by 3pp during the last 12 months to 15% in 2QFY11. Local retention averaged PKR 3776/ton, up 19% YoY in 1HFY11 whereas export retention, after adjusting for logistic cost, was PKR3584/ton. We expect Lucky cement to post FY11 local dispatches growth of 8%, outperforming industry by 12% pp as we expect FY11 local cement sales to fall 4% YoY for the industry.

… while export dispatches take a beating

Sluggish construction activities coupled with oversupply of cement in the Middle East caused LUCK’s 1HFY11 export dispatches to fall by 30% YoY. LUCK’s trademark loose cement exports to GCC markets declined by 58% YoY to 0.4 mn tons in 1HFY11. African exports remained staunched which led bagged exports (primarily to Afghanistan and Africa) to rise 8% YoY in 1HFY11. Though headline export retention price surged 26% YoY to USD65/ton in 2QFY11, it was largely due to higher share of CNF based contracts in the overall export mix. After adjusting the retention price for freight expense, the net realized price on exports would have been USD43/ton, 9% higher YoY. With LUCK being more leveraged to exports relative to its peers, we expect LUCK’S export dispatches to decline by 35% YoY to 2.2mn tons in FY11, whereas industry’s export dispatches will likely decline by 18% YoY to 8.8mn tons in FY11.

Rising selling prices offsetting cost increases and pushing EBITDA margins upwards

While 29% YoY increase cash cost per ton (COGS – depreciation + SG&A) during 2QFY11 outpaced 25% YoY rise in average net retentions, absolute increase in retentions still outpaced costs by PKR 106/ton. Resultantly, EBITDA margins during 2QFY11 rose 12% YoY to PKR 1007/ton. However, EBITDA margins for 1HFY11 dropped 6% YoY primarily due to 1QFY11 margin being 19% lower YoY due to high 1QFY11 base. EBITDA margins for LUCK lost footing post 1QFY10 and bottomed out in 4QFY10 at PKR 627/ton, following which they have been on a rising trend. EBITDA/ton increased 56% QoQ and 3% QoQ respectively, during 1Q and 2QFY11, while we expect 3QFY11 EBITDA margins to rise 12% QoQ due to cheaper coal inventories amid rising cement prices.

Investment perspective

We have valued LUCK through DCF based valuation, using risk free rate of 14%, market risk premium of 6%, terminal growth rate of 4% and a beta of 1.2. We set our Dec-11 Price Target for Lucky cement at PKR85/share. At yesterday’s closing of PKR 64/share, LUCK is trading at FY11/12 PER of 6.5x/6.0x. BUY!

Economic & Political News

Forward cover facility against imports restored

The State Bank of Pakistan (SBP), in order to meet the genuine needs of importers, has decided to restore the Forward Cover Facility against imports with immediate effect. Forward Cover Facility will be made available to importers against the Letter of Credit only and no facility will be provided for a period of less than one month. Roll over in those cases where import payment is not made in accordance with the schedule, will be allowed subject to the condition that the roll over is not less than one month.

Agriculture credit disbursement: banks achieve 54% target in 8MFY11

Commercial and specialized banks have achieved 54% of agricultural credit disbursement target during the 8MFY11. Year on Year (YoY) basis, the disbursement during the period increased by only 0.50% against the same period of last fiscal year. The State Bank of Pakistan’s (SBP) latest statistics revealed that in absolute terms, disbursement of credit to the agriculture sector surged by PKR725mn to PKR145.44bn in 8MFY11 when compared with total disbursement of PKR144.7bn in the same period of last fiscal year. Total disbursement during 8MFY11 is some 53.9% of indicative target of PKR270bn set by the State Bank of Pakistan for FY11.